California: esVolta & Atlantica secure tax equity,

Nov 14, 2023 · It is the first tax equity transaction for esVolta, which only develops battery storage projects, and was acquired by Generate Capital last year.

Get Started

Energy Storage Power Station Tax Payment Report: Your

Jun 12, 2024 · Let''s face it – tax reports are about as exciting as watching battery cells charge. But here''s the kicker: Getting your energy storage power station tax payment report right could

Get Started

How much tax does energy storage project have | NenPower

May 25, 2024 · Energy storage projects are subject to various taxation structures which differ based on numerous factors. 1. Federal tax credits can significantly reduce initial capital costs;

Get Started

What is the tax rate for energy storage projects?

Feb 13, 2024 · The approach to project financing can dramatically influence the effective tax rate for energy storage projects. Different financing structures,

Get Started

How banks evaluate energy storage | Norton Rose Fulbright

Aug 13, 2021 · The debt sits behind the tax equity in solar-plus-storage deals, and typically banks are being asked to monetize the full value of the PPA (or beyond). Warranties and service

Get Started

ITC Elective Pay Explainer

Dec 4, 2024 · To calculate the amount your § 48 or § 48E project is eligible for, multiply the applicable tax credit percentage by the "tax basis," or the amount spent on an eligible unit of

Get Started

Transferability a ''game changer'' for US clean

Jul 11, 2023 · New transferability provisions for tax credits are "a game changer for clean energy development", Shearman & Stirling''s Mona Dajani said.

Get Started

"One Big Beautiful Bill Act" Brings Big Changes to Green Energy Tax

Aug 6, 2025 · On July 4, 2025, President Trump signed into law a sweeping budget reconciliation bill commonly known as the " One Big Beautiful Bill Act " (the Act). The Act includes the

Get Started

IRS Releases Final Energy Property Regulations Under

Jan 10, 2025 · On December 4, 2024, the US Treasury and IRS issued final regulations (TD 10015) clarifying the definition of energy property and rules for the energy credit under Section

Get Started

From IRA to OBBBA: A New Era for Clean Energy

Jul 22, 2025 · The OBBBA introduces a fundamental realignment of federal clean energy policy, with immediate and long-term consequences for tax credit

Get Started

Tax bill significantly changes clean energy

Jul 15, 2025 · Elective payment elections, or direct pay, remain viable, but tax-exempt organizations may be impacted by changes to the credits just like

Get Started

Domestic Content Safe Harbor cost percentages

Jan 16, 2025 · The U.S. Department of the Treasury released additional guidance on the Inflation Reduction Act''s domestic content tax credit bonus for solar

Get Started

Energy sector tax provisions in "One Big Beautiful Bill"

Jul 22, 2025 · Further, an entity may be a foreign influenced entity if, during the previous tax year, it made a payment to a specified foreign entity pursuant to an agreement that entitles the

Get Started

What the US budget bill means for energy storage tax credit

Jul 23, 2025 · What the US budget bill means for energy storage tax credit eligibility While storage fared better than solar and wind, homeowners interested in residential batteries face dwindling

Get Started

US'' tax credit incentives for standalone energy

Jan 5, 2023 · Image: President Biden via Twitter. The Inflation Reduction Act''s incentives for energy storage projects in the US came into effect on 1 January

Get Started

Q&A on the Inflation Reduction Act

Aug 19, 2022 · Revised February 20, 2023 Q&A on the Inflation Reduction Act During our webcast on the tax provisions of the Inflation Reduction Act of 2022 (H.R. 5376) (the "IRA"),

Get Started

Tax-exempt investment in partnerships holding energy

Jul 31, 2025 · Investments in energy projects offer two primary tax benefits: the ITC and accelerated depreciation. Some developers cannot use these tax benefits themselves but can

Get Started

How does the Section 48E ITC differ from

Nov 15, 2024 · In essence, Section 48E modernizes and expands the investment tax credit framework to more inclusively cover energy storage technologies,

Get Started

Energy Storage Gets Its Own Credit: What Developers Need

4 days ago · Energy storage is playing a growing role in the clean energy transition, helping to stabilize the grid, store intermittent power, and enhance project performance. The Inflation

Get Started

48E Tax Credit: Claiming the Clean Electricity ITC

Feb 3, 2025 · Technology-neutral investment tax credits are now available for clean energy projects constructed or supplying energy in 2025. Since the

Get Started

Getting Cashback for Clean Energy: Direct Pay Tax

May 21, 2024 · Getting Cashback for Clean Energy: Direct Pay Tax Credits for Nonprofits May 21, 2024 Renew America''s Nonprofits Program DOE Office of State and Community Energy

Get Started

Gore Street to sell investment tax credits for California BESS

Jul 16, 2025 · Gore Street Energy Storage Fund (GSF) has entered into an agreement to sell its ITCs for the Big Rock energy storage project in California.

Get Started

The State of Play for Energy Storage Tax Credits

Mar 7, 2025 · Energy storage was one of the major beneficiaries of the IRA''s new rules on both the deployment and manufacturing sides. The IRA enacted the

Get Started

Effects of the Final House Tax Bill on Projects

May 22, 2025 · The tax credit amounts increase over time due to inflation adjustments. The House bill makes no change in the underlying tax credits. However, section 45Q tax credits

Get Started

What the budget bill means for energy storage

Jul 10, 2025 · The One Big Beautiful Bill Act (OBBB) is set to dramatically reshape how grid scale and residential energy storage systems are treated

Get Started

One Big Beautiful Bill Act to Scale Back Clean Energy Tax

Jun 30, 2025 · Following its approval by Congress, the One Big Beautiful Bill Act was signed by President Donald Trump on July 4, 2025. This Holland & Knight alert summarizes certain key

Get Started

IRS clarifies clean energy tax credit direct pay,

Jun 20, 2023 · The IRS has revealed how smaller and tax-exempt organisations can take use renewable tax credits using ''direct pay'' and transferability.

Get Started

"Prohibited Foreign Entity" restrictions in the OBBBA restrict tax

Jul 21, 2025 · A. Tax credits relevant for energy storage projects Among others, the following three tax credits are especially relevant to energy storage projects. All are impacted by the

Get Started

NEW REPORT: Battery Storage and Renewable Energy

Jan 5, 2023 · Click here to access an interactive map showing project size, tax, and landowner payment data per legislative district. AUSTIN, TEXAS – Renewable energy and battery

Get Started

Battery Energy Storage Financing Structures and

4 days ago · Battery Energy Storage Revenue Streams The varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for

Get Started

The State of Play for Energy Storage Tax Credits

Mar 7, 2025 · The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

Get Started

Economic Benefits of Energy Storage

Aug 12, 2025 · Today, operating U.S. grid-scale energy storage projects deliver over $580 million each year to local communities in the form of tax revenue and land lease payments.

Get Started

The Economic Impact of Renewable Energy and Energy

Jan 6, 2025 · Executive Summary This analysis assesses many aspects of utility-scale wind, solar, and energy storage investments in Texas, including local tax collections, landowner

Get Started

Energy Storage Project Revenue Risk: What

Aug 11, 2025 · The new tax credit makes it cheaper for anyone to join an energy storage project - the ITC can be transferred from a project owner to an

Get Started

Related Articles

-

Iran Gravity Energy Storage Tower Project

Iran Gravity Energy Storage Tower Project

-

Cairo Low Carbon Energy Storage Project

Cairo Low Carbon Energy Storage Project

-

Energy Storage Project Implementation and Delivery Plan

Energy Storage Project Implementation and Delivery Plan

-

Peru energy storage investment 2 billion project

Peru energy storage investment 2 billion project

-

Dubai Battery Energy Storage Project

Dubai Battery Energy Storage Project

-

How much does it cost to invest in a 1mkw energy storage project

How much does it cost to invest in a 1mkw energy storage project

-

Asia Capacitor Energy Storage Project

Asia Capacitor Energy Storage Project

-

Kinshasa 2025 Energy Storage Project

Kinshasa 2025 Energy Storage Project

-

Guatemala Battery Energy Storage Project

Guatemala Battery Energy Storage Project

-

Lesotho Wind Power Energy Storage Project

Lesotho Wind Power Energy Storage Project

Commercial & Industrial Solar Storage Market Growth

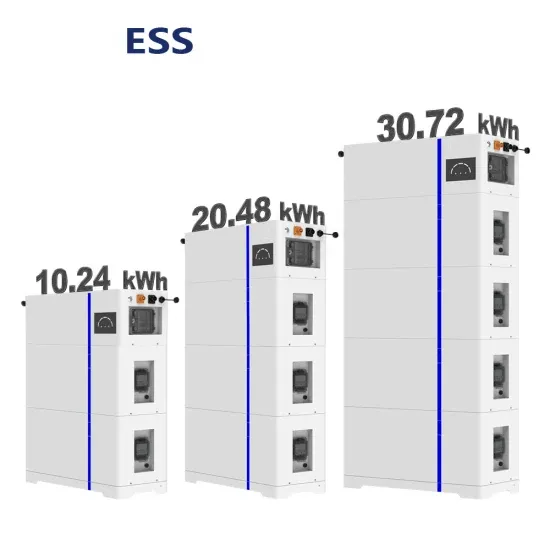

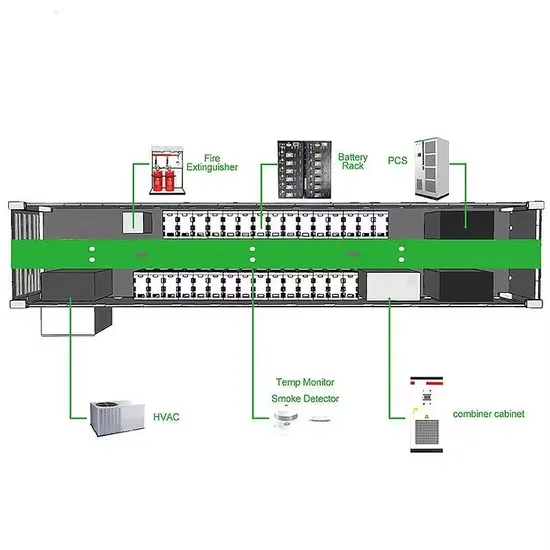

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.