How much electricity price can energy storage be profitable?

Sep 26, 2024 · Furthermore, regulations that incorporate energy storage into grid planning and resource adequacy assessments foster the inclusion of these technologies in energy markets.

Get Started

Can energy storage at charging stations make money?

Can energy storage at charging stations make money? In the charging station industry, what is the hottest topic? How much energy storage should be installed in charging stations?

Get Started

How can energy storage companies make money quickly?

Jun 18, 2024 · 1. Rapid monetization of energy storage businesses can be achieved through various strategies including: 1) providing ancillary services, 2) participating in energy markets,

Get Started

How much money can energy storage power stations make?

Aug 16, 2024 · Moreover, network stabilization services can also contribute significantly to income. Storage power stations provide vital support for grid stability, especially in regions

Get Started

HOW MUCH MONEY CAN A HYBRID ENERGY STORAGE

How to make money with energy storage on the power generation side Identifying and prioritizing projects and customers is complicated. It means looking at how electricity is used and how

Get Started

How much electricity price can energy storage make a

How much money would a power plant make if no storage? Four power plants--Martin Lake,Midlothian Energy,Forney Energy Center,and Odessa Ector Generating Station--could

Get Started

Evaluating energy storage tech revenue

Feb 11, 2025 · Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various

Get Started

How much does photovoltaic energy storage equipment cost?

Aug 3, 2024 · Investing in photovoltaic energy storage equipment entails multifaceted considerations, including costs related to equipment type and installation complexity.

Get Started

How Much Money Can I Save With Solar Energy?

Aug 1, 2024 · Lowering electricity bills is one of the main reasons why consumers may decide to install rooftop solar panels. So how much can someone actually

Get Started

How Much Does an Owner Make from Energy Storage

Aug 4, 2025 · Learn how much profit an owner can expect from energy storage solutions. Understand key financial factors and market demand.

Get Started

HOW TO MAKE ENERGY STORAGE BANKABLE

How energy storage systems make money Identifying and prioritizing projects and customers is complicated. It means looking at how electricity is used and how much it costs, as well as the

Get Started

The Complete Guide to Energy Storage Systems:

Jan 6, 2025 · Learn about the advantages and challenges of energy storage systems (ESS), from cost savings and renewable energy integration to policy incentives and future innovations.

Get Started

How much money can energy storage emu make | NenPower

Feb 7, 2024 · In the realm of energy storage, the financial potential of EMUs (Energy Management Units) is substantial, shaped by key factors: 1. The market demand for energy

Get Started

How is Energy Storage Profitable? Unlocking the Billion

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

Get Started

Solar Batteries: How Much Can You Save?

Apr 26, 2023 · Another important consideration when determining how much energy storage can save you is the question of what type of utility rate you are

Get Started

BESS Costs Analysis: Understanding the True Costs of Battery Energy

Aug 29, 2024 · Exencell, as a leader in the high-end energy storage battery market, has always been committed to providing clean and green energy to our global partners, continuously

Get Started

The economic impact of energy storage

Nov 27, 2015 · Energy storage has the potential to transform the global economy by making power load management more efficient, by providing a reliable

Get Started

Battery Energy Storage System Production Cost

Case Study on Battery Energy Storage System Production: A comprehensive financial model for the plant''s setup, manufacturing, machinery and operations.

Get Started

How much can energy storage reduce electricity prices?

Mar 29, 2024 · 1. Energy storage can significantly lower electricity costs, primarily by facilitating the integration of renewable energy sources into the grid, optimizing dem

Get Started

How much does it cost to build a battery energy

How much does it cost to build a battery in 2024? Modo Energy''s industry survey reveals key Capex, O&M, and connection cost benchmarks for BESS projects.

Get Started

Income Potential for Energy Storage Business Owners

Apr 17, 2025 · Energy storage business salary typically ranges between $50K and $150K per year, varying by scale, location, and specialization. Keep reading to understand how factors

Get Started

How Much Does an Owner Make from Energy Storage

Aug 4, 2025 · Owners of larger, more complex Energy Storage Solutions businesses, especially those involved in utility-scale Battery Energy Storage System (BESS) projects, can command

Get Started

How much does electric energy storage equipment cost?

Feb 10, 2024 · Electric energy storage equipment varies significantly in price based on technology, capacity, and application. 1. The average cost for lithium-ion battery systems

Get Started

What Is The Current Average Cost Of Energy Storage

Jul 9, 2025 · In 2025, the average energy storage cost ranges from $200 to $400 per kWh, with total system prices varying by technology, region, and installation factors.

Get Started

How much profit does energy storage battery

Sep 26, 2024 · The profitability of an energy storage battery agent largely depends on various factors including market demand, operational costs, and

Get Started

How much price difference can make energy storage

Jun 7, 2024 · 1. The profitability of energy storage varies significantly with price differentials, influenced by multiple factors. 2. A higher price spread between peak and off-peak energy

Get Started

What Profit Analysis Does Energy Storage Include? A 2025

Mar 25, 2021 · Shared storage systems can generate ¥25-35 million annually for a 100MW facility by renting out their capacity [1] [8]. It''s like having a power apartment building that collects rent

Get Started

How Much Can a 1MWh Energy Storage System Save for

Jul 8, 2025 · Three core mechanisms for saving money on energy storage systems Peak-Valley Arbitrage: Charge during low-price periods, discharge during peak-price periods. Demand

Get Started

6 FAQs about [How much money can energy storage equipment make ]

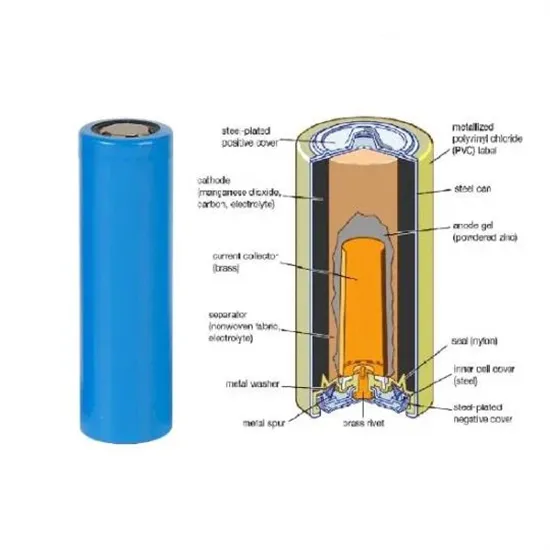

How much does the energy storage system cost?

The energy storage system is a 4MW, 32MWh NaS battery consisting of 80 modules, each weighing 3 600 kg. The total cost of the battery system was USD 25 million and included USD 10 million for construction of the building to house the batteries (built by Burns & McDonnell) and the new substation at Alamito Creek.

Can energy storage save you money?

If you have a renewable electricity generator like solar panels or a wind turbine, installing energy storage will save you money on your electricity bills. You need to weigh the potential savings against the cost of installation and how long the battery will last.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Should energy storage be undervalued?

The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true estimate—improving profitability and supporting sustainability goals.

How important are ancillary services to energy storage?

Ancillary services that stabilize the power grid typically represent 50 to 80 percent of the full storage revenue stack of energy storage assets deployed today. This is observed across multiple mature storage markets but is expected to decrease to less than 40 percent by 2030.

Related Articles

-

How many types of energy storage devices are there for electrical equipment

How many types of energy storage devices are there for electrical equipment

-

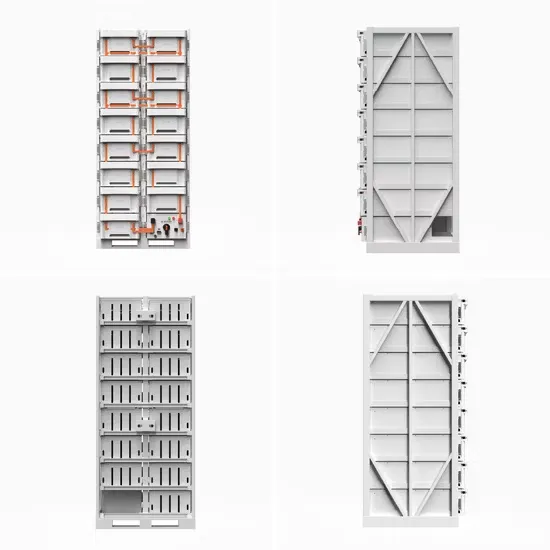

List of equipment needed to make an energy storage cabinet

List of equipment needed to make an energy storage cabinet

-

How much does 300 kWh of energy storage equipment cost

How much does 300 kWh of energy storage equipment cost

-

How much does the energy storage equipment cost in Port Vila

How much does the energy storage equipment cost in Port Vila

-

How much does household energy storage equipment cost

How much does household energy storage equipment cost

-

How much does the battery energy storage system equipment for Cambodian communication base stations cost

How much does the battery energy storage system equipment for Cambodian communication base stations cost

-

How much does Tonga EK energy storage equipment cost

How much does Tonga EK energy storage equipment cost

-

How to connect the small energy storage cabinet of base station communication equipment

How to connect the small energy storage cabinet of base station communication equipment

-

How much does the Finnish energy storage equipment box cost

How much does the Finnish energy storage equipment box cost

-

215 How to make outdoor energy storage cabinet waterproof

215 How to make outdoor energy storage cabinet waterproof

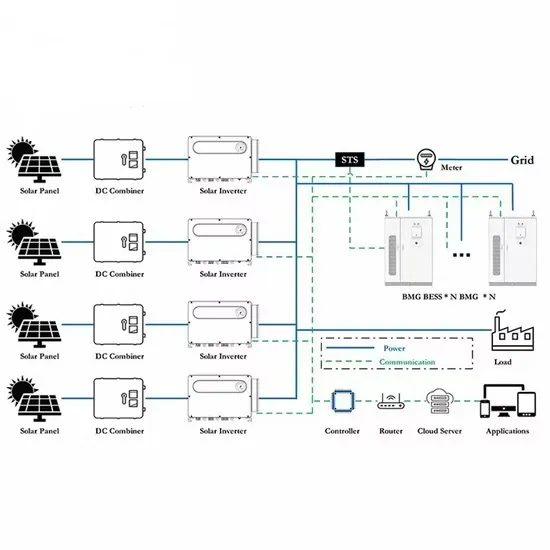

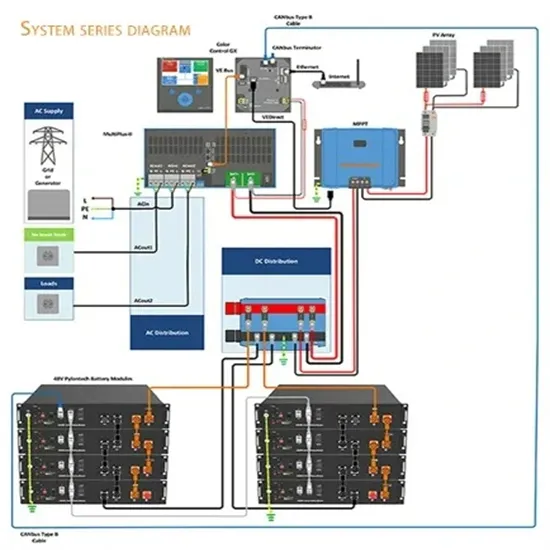

Commercial & Industrial Solar Storage Market Growth

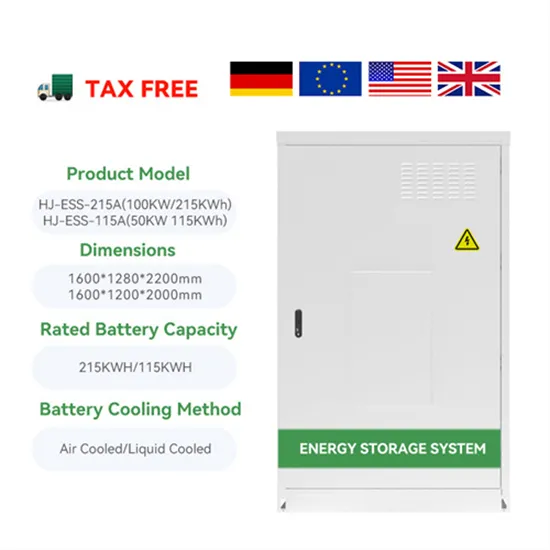

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.