Private equity targets battery energy storage, driven largely

Aug 17, 2025 · The value of private equity and venture capital investments in battery energy storage system, energy management and energy storage reached $17.86 billion by Aug. 20,

Get Started

Energy storage – an accelerator of net zero target with US

Jan 6, 2022 · Since we first published a Q-Series on the Energy Storage theme, the market has developed ahead of our expectations, owing to technology-induced cost reductions and

Get Started

Four factors to guide investment in battery storage | EY

In this webcast, panelists discuss global investment trends in battery energy storage systems (BESS) and the four factors that can help investors navigate risks.

Get Started

Batteries Are the ''Next Solar'' for Investors, Says KKR

Aug 27, 2024 · Batteries are the next big green investment opportunity, the co-head of climate strategy at Kohlberg Kravis Roberts & Co., Emmanuel Lagarrigue, told BloombergNEF.

Get Started

US energy sector set to invest $100B in battery

May 10, 2025 · The ACP has committed to investing $100 billion over the next five years to build and buy American-made battery storage.

Get Started

Understanding the Return of Investment (ROI): battery energy storage

5 days ago · Several key factors influence the ROI of a BESS. This article explores the various factors influencing the return of investment of BESS.

Get Started

Battery-Based Energy Storage: Our Projects and

Aug 18, 2025 · TotalEnergies develops battery-based electricity storage solutions, an essential complement to renewable energies. Find out more about our

Get Started

Energy Storage Stocks: Investment Opportunities in

Mar 28, 2025 · As the world increasingly transitions towards renewable energy, the importance of energy storage has never been more pronounced. This article explores various energy storage

Get Started

Energy Storage | ACP

Aug 18, 2025 · The energy storage industry has announced a historic commitment to invest $100 billion in building and buying American-made grid batteries, including capital for new battery

Get Started

Battery Storage Investments 2025: Boosting ESG & Net-Zero

1 day ago · Battery storage investments in 2025 are experiencing unprecedented growth, reshaping the global energy transition and corporate ESG strategies. The surge is not only a

Get Started

US Energy Storage Industry Commits $100 Billion Investment

Apr 30, 2025 · US Energy Storage Industry Commits $100 Billion Investment in American-Made Grid Batteries WASHINGTON, D.C., April 29, 2025 – Today the American Clean Power

Get Started

U.S. Department of Energy Selects 11 Projects to

Dec 19, 2024 · WASHINGTON, D.C. — The U.S. Department of Energy (DOE) today announced an investment of $25 million across 11 projects to advance

Get Started

Top 10 New Energy Storage Investments Shaping 2025 (and

Apr 17, 2025 · The global energy storage market, now worth $263 billion, is growing faster than a Tesla Plaid Mode acceleration, with China alone adding 31.39GW/66.87GWh of new storage

Get Started

White paper BATTERY ENERGY STORAGE SYSTEMS

Jun 24, 2024 · 1. The technological framework of battery storage As short-term storage devices, batteries offer a high degree of flexibility by balancing power outputs and scheduling

Get Started

U.S. Energy Storage Industry Commits $100 Billion Investment

May 2, 2025 · The American Clean Power Association (ACP), on behalf of the U.S. energy storage industry, announced a historic commitment to invest $100 billion into building and

Get Started

US energy storage sector commits to $100B

Apr 30, 2025 · US energy storage sector commits to $100B investment by 2030 The pledge represents a more than fivefold jump in "active investments" and

Get Started

Investment trends in grid-scale battery storage

Jul 28, 2021 · Assessing COVID-19''s Impact on Battery Storage Deployments Per the IEA''s World Energy Investment 2021 report, energy storage was already

Get Started

U.S. Energy Storage Industry to Invest $100 Billion in

4 days ago · The energy storage industry is planning to deliver and expand upon these investments and continue the battery manufacturing boom jump-started by rapid energy

Get Started

Investing in the grid: PE''s battery storage

Feb 21, 2025 · As investment in energy infrastructure continues to grow, PE firms are turning to large-scale battery storage to solve the issue of storing

Get Started

Utility-scale battery storage opens up for investors

Aug 5, 2025 · As more renewable energy comes online, there''s a growing need to balance intermittent supply hitting the energy networks. Utility-scale battery storage has become the

Get Started

Battery Energy Storage Tax Credits in 2024

Jan 12, 2024 · Among the many provisions of the IRA, the introduction of battery storage system tax credits stands out as a major incentive for individuals and

Get Started

Top Battery Storage Companies to Watch in

Jun 1, 2025 · LG Energy Solution is a significant force in the next-generation battery revolution, making substantial investments in cutting-edge

Get Started

Private equity targets battery energy storage, driven largely

Aug 17, 2025 · Private equity and venture capital investments in the battery energy storage system, energy management and energy storage sector so far in 2024 have exceeded 2023''s

Get Started

We''re about to see a $1 trillion ''super-cycle'' of investment in

Aug 1, 2025 · After record growth in 2024, U.S. battery energy storage systems (BESS) could grow from more than 26 gigawatts (GW) of capacity—enough to power 20 million homes—to

Get Started

Battery storage project pipeline in Romania in rapid expansion

Aug 16, 2025 · In a rising investment wave, firms in Romania are combining energy storage with solar, wind and hydropower or building standalone systems.

Get Started

Powering the Future: Top Venture Capitalists

Mar 19, 2023 · The IEA says that global investment in battery energy storage reached almost USD 10 billion in 2021. It is led by grid-scale deployment,

Get Started

Millions invested in big batteries amid net zero

Apr 22, 2025 · A large battery project in South Australia sells for nearly $500 million as investment in renewable energy surges.

Get Started

China''s role in scaling up energy storage investments

Jun 1, 2023 · This study explores the challenges and opportunities of China''s domestic and international roles in scaling up energy storage investments. China aims to increase its share

Get Started

Top Renewable Energy & Battery Storage Stocks Worth

Mar 17, 2025 · The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing global electricity demand.

Get Started

Energy Storage Investments – Publications

Mar 7, 2025 · Investors may look toward battery storage solutions with differing investment theses. For example, energy storage systems are seen by some investors as a potential

Get Started

Investing in the grid: PE''s battery storage

Feb 21, 2025 · Battery storage is essential for integrating renewable energy into the grid, mitigating intermittency issues and enhancing energy security. Policy

Get Started

6 FAQs about [Investment in energy storage batteries]

Why should you invest in battery storage?

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables, surging electricity demand from new industrial loads, and supportive policy frameworks worldwide.

Why is PE investment in battery energy storage growing?

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE investments in energy storage and infrastructure have more than doubled since 2014, reaching $21.1 billion in 2024 alone.

Is battery storage a fundamental part of energy infrastructure?

“Battery storage is now viewed as a fundamental part of energy infrastructure, much like LNG terminals and oil tankers,” said Gresham House infrastructure and energy transition investor Lefteris Stakosias. Stakosias said this investment boom reflects a broader shift in the global energy market toward renewables.

Why is battery energy storage important?

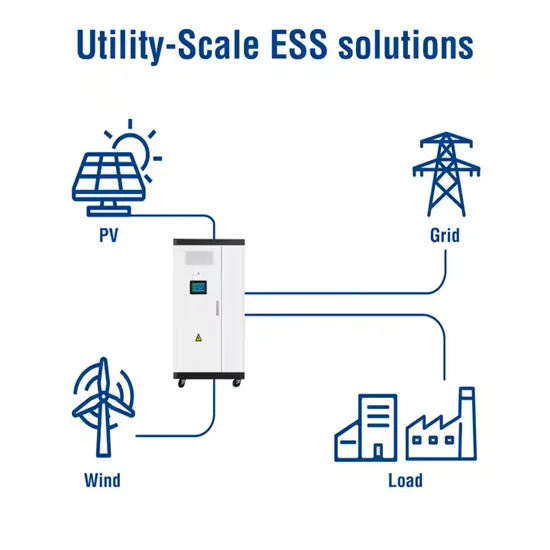

At the heart of this transition lies battery energy storage, an indispensable technology for ensuring grid stability, reliability, and the efficient integration of intermittent power generation from sources like solar and wind.

How big will a battery energy storage system be in 2024?

After record growth in 2024, U.S. battery energy storage systems (BESS) could grow from more than 26 gigawatts (GW) of capacity—enough to power 20 million homes—to anywhere from 120 GW to 150 GW by the end of 2030, depending on the range of projections.

What makes a battery investment a success?

Success requires understanding the dynamic interaction of regional variations, electricity market design, technology and financing — as well as an acceptance of volatility. To help cut through the complexity, EY teams have identified and ranked the attractiveness of the world’s top global battery investment markets for the first time.

Related Articles

-

Investment in energy storage batteries

Investment in energy storage batteries

-

Cyprus imports energy storage batteries

Cyprus imports energy storage batteries

-

Are solid-state batteries suitable for energy storage

Are solid-state batteries suitable for energy storage

-

What are the special energy storage batteries in Nicaragua

What are the special energy storage batteries in Nicaragua

-

Can energy storage batteries also be used in conjunction with the grid

Can energy storage batteries also be used in conjunction with the grid

-

Energy storage batteries to be built in Colombia

Energy storage batteries to be built in Colombia

-

Latest material requirements for energy storage batteries

Latest material requirements for energy storage batteries

-

Energy storage batteries replace power batteries

Energy storage batteries replace power batteries

-

Budapest companies that make energy storage batteries

Budapest companies that make energy storage batteries

-

Price of energy storage batteries in Tampere Finland

Price of energy storage batteries in Tampere Finland

Commercial & Industrial Solar Storage Market Growth

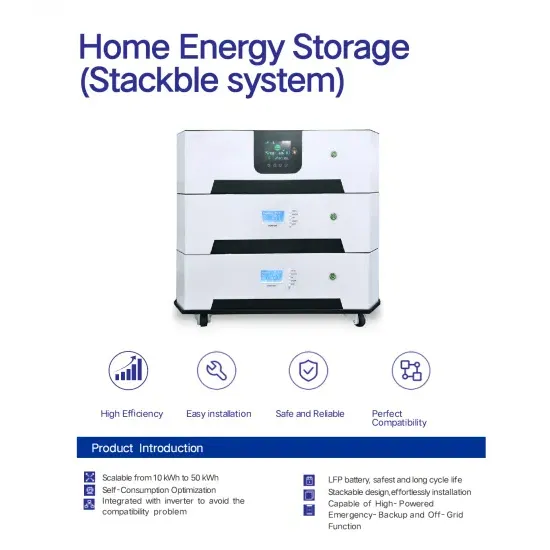

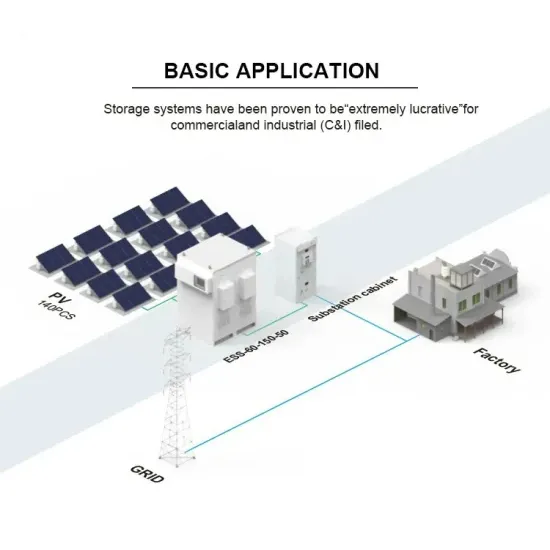

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.