China lowers tax incentives on battery exports

According to a statement last week, the export tax rebate rate for some products, including lithium batteries and some non-ferrous mineral products will be

Get Started

(PDF) A Proposal for a Decarbonization Tax

Nov 14, 2022 · To realize these benefits current investment in lithium is much lower than the production of lithium batteries used in EVs requires, reflecting

Get Started

Budget 2025: EV Battery Production Gets Boost,

Feb 1, 2025 · Tax exemptions for lithium battery production, the removal of Basic Customs Duty on critical minerals, and the duty-free import of key EV battery

Get Started

How Smart Tax Policy Could Help Stabilize Lithium Supply

Aug 12, 2025 · Opinion: Tax adviser Anthony Assassa looks at the different international models for lithium taxation and suggests that a jointly developed smart tax policy could support both

Get Started

China slashes export tax rebates for solar panels

Nov 20, 2024 · The new policy eliminates rebates for 59 products and reduces the rebate rate from 13% to 9% for 209 items, including refined oil, solar

Get Started

From Raw Materials to Finished Product: The

Nov 10, 2024 · From obtaining raw lithium brine and extracting and purifying raw material to manufacturing and testing Li-ion cells to assembling the cells and

Get Started

U.S Tariffs On Lithium Ion Batteries Effect On Small Battery

Apr 11, 2025 · The recent increase in U.S. tariffs on Chinese-made lithium-ion batteries is poised to significantly affect small businesses in the battery sector. Effective January 1, 2026, Section

Get Started

GST on Battery: Applicability, Rate and HSN Code

GST Rate and HSN Code For Battery: Are you a battery supplier and want to know the applicability of GST on batteries and the various exemptions? This article covers all you need

Get Started

How Smart Tax Policy Could Help Stabilize Lithium Supply

Aug 12, 2025 · Higher upstream lithium taxation will cascade into battery costs, adversely affecting electric vehicles'' affordability and grid storage economics. Tax rate increases may

Get Started

Friendshoring the Lithium-Ion Battery Supply Chain: Final

Jun 11, 2024 · The last report in a series of three, this piece outlines the assembly of lithium-ion battery cells into modules as well as different battery end-uses, and addresses current U.S.

Get Started

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

In April 2025, the U.S. government updated its tariff policy on lithium-ion batteries imported from China. The current tariff structure includes: A 3.4% global tariff on lithium-ion batteries,

Get Started

Know The Ultimate List Of Battery Charger GST

Aug 18, 2024 · GST Rates for Electric Vehicle Batteries Initially, batteries for electric vehicles, like lithium-ion battery packs, attracted a higher GST rate.

Get Started

US Lithium Battery Import Tariff Tncrease

Apr 10, 2025 · US lithium battery import tariff increase: A new energy game that affects the world On 10 April 2025, United States President Donald Trump announced via social media his

Get Started

Scrapping Custom Duty On Lithium-Ion Battery

Feb 1, 2025 · The scrapping of basic customs duty on the import of lithium-ion battery scrap and capital goods - or the machinery used to manufacture

Get Started

Advance Ruling on Lithium-Ion Cell Imports for

Nov 26, 2024 · Analysis of CAAR Mumbai''s ruling for Sunwoda Electronics on concessional customs duty for lithium-ion cells and parts used in

Get Started

Techno-economic analysis of lithium-ion battery price

Nov 1, 2023 · Secondly, techno-economic analysis predicts that the mean price of EV battery packs with diverse chemical compositions will decline to $75.1/kWh by 2030, factoring in the

Get Started

China''s Bold Export Tax Shake-Up: How

Nov 16, 2024 · The rebate rate for PV panels, lithium batteries, refined petroleum, and select non-metallic minerals will drop from 13% to 9%. Given China''s

Get Started

20% lithium battery duty slows solar energy

Jan 6, 2023 · The price of lithium-ion batteries surged to a record high in 2022, leading to higher prices in electricity-starved markets like Nigeria. Operators

Get Started

Consumption tax for producing lithium batteries

Consumption tax for producing lithium batteries companies Why is lithium-ion battery demand growing? Strong growth in lithium-ion battery (LIB) demand requires a robust understanding of

Get Started

Lithium-ion battery recyclers see challenges, opportunities

Aug 18, 2025 · Lithium-ion battery recyclers see challenges, opportunities under Trump While the administration has moved to strip electric vehicle incentives and cancel some grants, it''s still

Get Started

On December 1, the export tax rebate of lithium battery

Nov 18, 2024 · Among them, particularly notable is the reduction of the export tax rebate rate for photovoltaic and battery products, from the original 13% to 9%. It is undoubtedly a major

Get Started

Union Budget 2025: Customs Duty Exemptions

Feb 1, 2025 · In a significant move during the Union Budget presentation, Finance Minister Nirmala Sitharaman announced a series of tax exemptions on key

Get Started

Section 45X of the Inflation Reduction Act: New

The Congressional Research Service estimates that the tax relief available under the PTC will cost the United States upwards of $31 billion. Tax Credit for

Get Started

Navigating China''s Export Tax Rebate Policy

Nov 19, 2024 · Here''s why a 4% rebate cut is more than just a number: Thin Margins, Big Impact: The manufacturing process for lithium-ion batteries

Get Started

Export Tax Rebate Cut: Energy Storage Battery

Nov 22, 2024 · The export tax rebate rates for a number of products, including refined oil, photovoltaics, batteries, and certain non-metallic mineral products,

Get Started

How Do China''s Subsidies and Tax Incentives Boost Battery

Jun 15, 2025 · China offers direct subsidies, tax rebates, R&D grants, and production-linked incentives to battery manufacturers. Programs like the "Made in China 2025" initiative prioritize

Get Started

China''s 2024 Trade Strategy: Tariff Adjustments

3 days ago · Additionally, China eliminated the 3% import tax on low-arsenic fluorite, a crucial material for electrolyte production in lithium-ion batteries. The

Get Started

Govt May Cut GST Tax On EV Batteries

Jun 9, 2022 · The Indian government''s GST council may bring down the tax rates on lithium-ion batteries used in EVs claims a new report. Lithium-ion batteries,

Get Started

Union Budget 2025: Customs Duty Exemptions for EV Battery

Feb 1, 2025 · In a significant move during the Union Budget presentation, Finance Minister Nirmala Sitharaman announced a series of tax exemptions on key components required for

Get Started

Tax standards for producing lithium batteries

Following a new set of tariffs announced by the Biden Administration in May 2024, the duty rate on lithium-ion EV batteries was raised from 7.5% to 25%, and non-EV batteries will raise to

Get Started

Effects of demand and recycling on the when and where of lithium

May 29, 2025 · Modelling now shows the likely number of new lithium deposit openings required by 2050 if the demand for larger battery packs continues and suggests moderating battery size

Get Started

Consumption tax for companies producing lithium

In February, the two companies agreed to produce batteries for EVs manufactured at Giga Shanghai, Tesla''''s second battery megafactory. 17 Tesla is currently producing Model 3''''s at

Get Started

Lithium Loop | Governor''s Office of Economic

Jun 19, 2025 · The battery packs include Battery Management Systems, which are computers, high-power electronics, and connections that maintain the

Get Started

6 FAQs about [Tax rate for producing lithium battery packs]

Will lithium batteries get a tax rebate?

According to a statement last week, the export tax rebate rate for some products, including lithium batteries and some non-ferrous mineral products will be reduced from 13% to 9%.

Will China reduce the export tax rebate for lithium batteries & photovoltaic products?

On December 1, 2024, a new policy comes into effect in China, reducing the export tax rebate for lithium batteries and photovoltaic products from 13% to 9%. As a professional deeply engaged in tracking global trade and renewable energy trends, this announcement demands closer examination—not just fo

What are China's new import taxes on lithium ion batteries?

This includes the removal of import taxes on lithium chloride, lithium carbonate, nickel sulphate, and cobalt carbonate, all previously set at 5%. Additionally, China eliminated the 3% import tax on low-arsenic fluorite, a crucial material for electrolyte production in lithium-ion batteries.

What is the US tariff policy on lithium ion batteries?

In April 2025, the U.S. government updated its tariff policy on lithium-ion batteries imported from China. The current tariff structure includes: A 3.4% global tariff on lithium-ion batteries, regardless of origin. A Section 301 tariff targeting Chinese imports, currently at 7.5%, is scheduled to rise to 25% by January 2026.

Which countries import lithium-ion batteries?

Lithium-ion batteries power various technologies, from smartphones to electric vehicles and grid storage. China dominates the global lithium battery supply chain, producing over 75% of the world’s lithium-ion battery cells. The U.S. imports nearly 70% of its lithium batteries from China, making tariffs on these products highly impactful.

Why are Chinese lithium batteries being tariffed in US-China trade?

Additional tariffs imposed under recent trade actions push the total tariff on Chinese lithium batteries to approximately 82% by 2026. These tariffs are part of a broader strategy to reduce U.S. dependence on Chinese battery imports and encourage domestic production. Part 2. Why are lithium batteries necessary in U.S.-China trade?

Related Articles

-

The development prospects of lithium battery packs

The development prospects of lithium battery packs

-

Are lithium batteries all small battery packs

Are lithium batteries all small battery packs

-

Can lithium battery packs be exported

Can lithium battery packs be exported

-

Lithium battery packs used in medical applications

Lithium battery packs used in medical applications

-

How many A are 21 strings of 72V lithium battery packs

How many A are 21 strings of 72V lithium battery packs

-

Panama high rate lithium battery pack

Panama high rate lithium battery pack

-

Castrie makes lithium battery packs

Castrie makes lithium battery packs

-

Maldives high rate lithium battery pack

Maldives high rate lithium battery pack

-

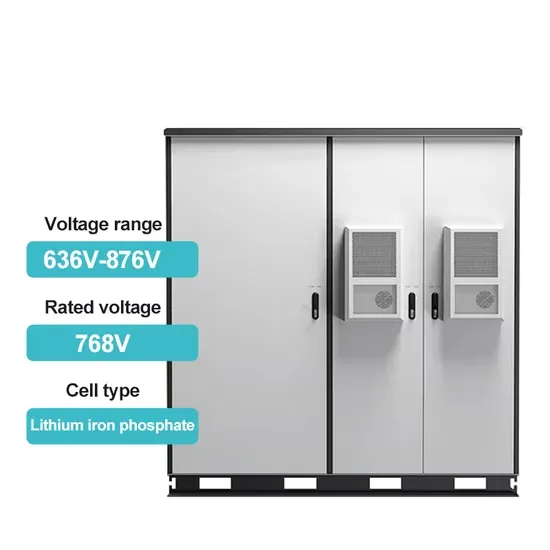

4 lithium iron phosphate battery packs

4 lithium iron phosphate battery packs

-

How many strings of lithium iron phosphate battery packs

How many strings of lithium iron phosphate battery packs

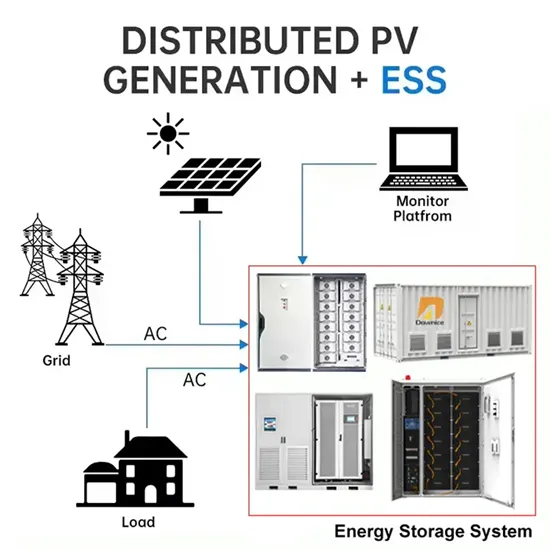

Commercial & Industrial Solar Storage Market Growth

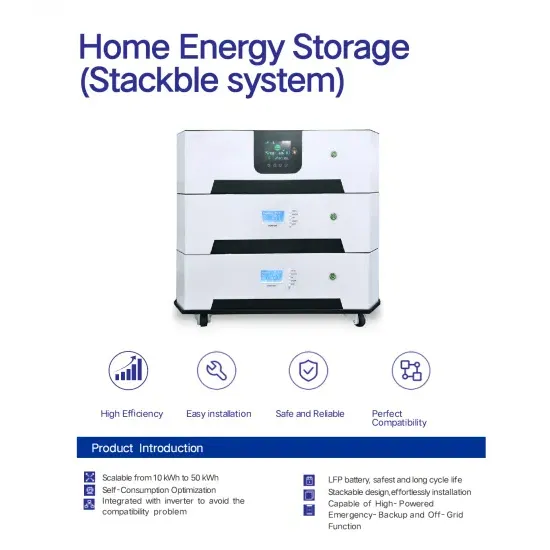

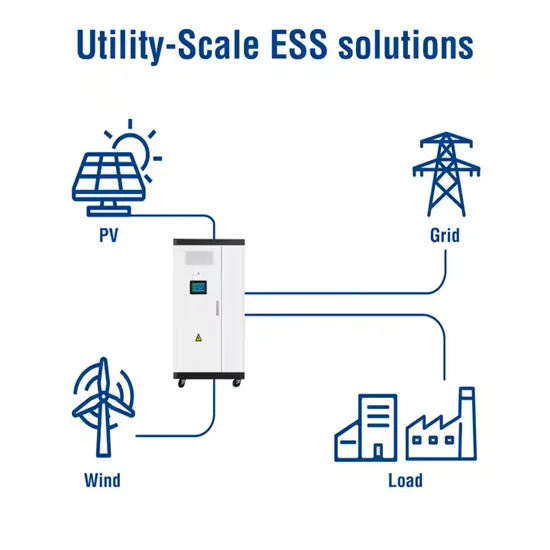

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

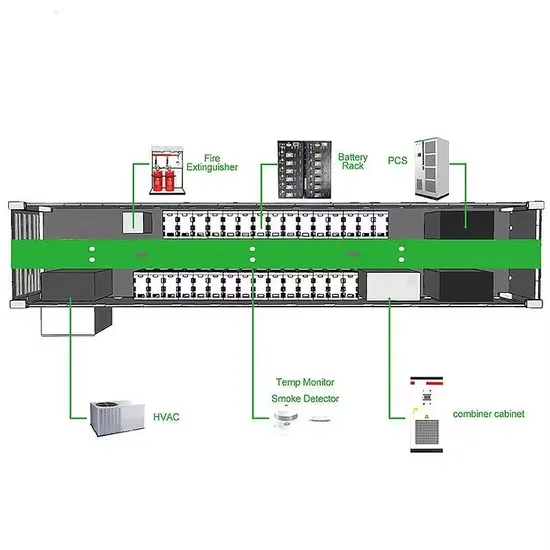

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.