Energy Storage Power Station Project Case EPC: Trends,

Imagine building a Tesla-sized battery park in 12 months flat – that''s the high-stakes world of energy storage EPC projects. With global energy storage capacity projected to grow 15-fold by

Get Started

Capital Cost and Performance Characteristics for Utility

Feb 15, 2024 · To accurately reflect the changing cost of new electric power generators in the Annual Energy Outlook 2025 (AEO2025), EIA commissioned Sargent & Lundy (S&L) to

Get Started

WHAT IS EPC AMP PPA BUSINESS MODEL

What does the business model of energy storage power station mean Building upon both strands of work, we propose to characterize business models of energy storage as the combination of

Get Started

Energy Storage Valuation: A Review of Use Cases and

Jun 24, 2022 · Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any

Get Started

summary of the analysis report on the profit model of energy storage

Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Get Started

Business Models and Profitability of Energy

Sep 11, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in electricity storage and the

Get Started

Exploration of Shared Energy Storage Business Model

Aug 12, 2023 · Using Hunan Province shared energy storage power plant economic analysis was done, and recommendations for the future advancement of shared energy storage were

Get Started

Energy Storage: An Overview of PV+BESS, its

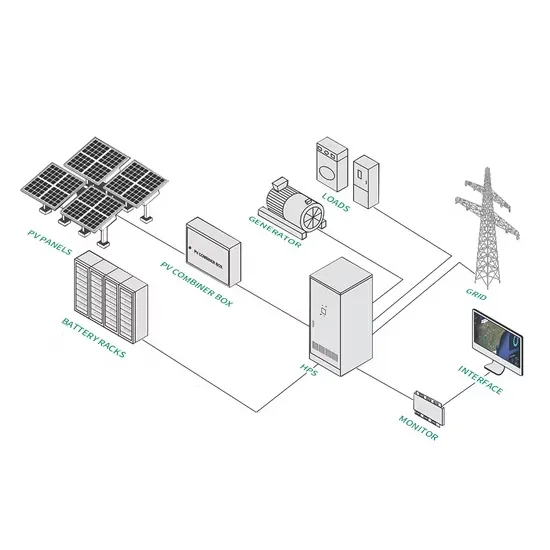

Jan 18, 2022 · Battery energy storage can be connected to new and existing solar via DC coupling Battery energy storage connects to DC-DC converter. DC-DC converter and solar are

Get Started

Key Considerations for Utility-Scale Energy

Mar 8, 2023 · It''s generation . . . it''s transmission . . . it''s energy storage! The renewable energy industry continues to view energy storage as the superhero

Get Started

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Get Started

Energy storage epc profit model

What are business models for energy storage? Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model

Get Started

Energy storage power station construction budget plan EPC

Do power project EPC contracts impose PLDs? As a result, power project EPC Contracts normally impose two types of PLDs, one for output (for example, how many megawatts the

Get Started

Project Financing and Energy Storage: Risks and

Mar 8, 2023 · The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Get Started

EPC contracts in the solar sector

May 1, 2024 · An EPC Contract delivers these requirements in a single integrated package, which is one of the major reasons why EPC Contracts are the most common form of construction

Get Started

Optimising hybrid power plants for long-term

May 1, 2025 · Alper Peker and Dominic Multerer of CAMOPO explain how flexibility is the key to long-term profitability for hybrid renewables-plus-storage

Get Started

How about EPC of energy storage power station | NenPower

Jan 26, 2024 · 1. EPC IN ENERGY STORAGE POWER STATIONS ENCOMPASSES THREE PRIMARY COMPONENTS: ENGINEERING, PROCUREMENT, AND CONSTRUCTION, 2.

Get Started

Energy storage epc profit model

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Get Started

summary of the special work of energy storage power station epc

Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Get Started

Optimal price-taker bidding strategy of distributed energy storage

Sep 13, 2024 · As an emerging flexible resource in the power market, distributed energy storage systems (DESSs) play the dual roles of generation and consumption (Kalantar-Neyestanaki

Get Started

How is the profit model of energy storage power station

Jan 27, 2024 · The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Get Started

Energy Storage Power Station Project Case EPC: Trends,

With global energy storage capacity projected to grow 15-fold by 2040 according to BloombergNEF, EPC (Engineering, Procurement, Construction) has become the backbone of

Get Started

EPC Contracts in the power sector

Feb 22, 2016 · This paper will only focus on the use of EPC Contracts in the power sector. However, the majority of the issues raised are applicable to EPC Contracts used in all sectors.

Get Started

Business Models and Profitability of Energy

Sep 11, 2020 · Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment

Get Started

epc for the transformation of old battery energy storage stations

Efficient operation of battery energy storage systems, electric-vehicle charging stations and renewable energy Additionally, technological improvements in battery energy storage have

Get Started

Profit analysis related to energy storage sector

Therefore, this article analyzes three common profit models that are identified when EES participates in peak-valley arbitrage, peak-shaving, and demand response. On this basis, take

Get Started

Energy storage power station bidding plan

A novel bidding model is incorporated into a profit maximization model to determine the optimal bids in day-ahead energy, spinning reserve, and regulation markets and

Get Started

Development and forecasting of electrochemical energy storage

May 10, 2024 · In this study, the cost and installed capacity of China''s electrochemical energy storage were analyzed using the single-factor experience curve, and the economy of

Get Started

Evaluating energy storage tech revenue

Feb 11, 2025 · Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various

Get Started

Emergence of 2.0 Profit Models for Industrial and Commercial Energy

May 26, 2025 · Overall, storage stations in Jiangsu have effectively restored revenue losses from the previous single peak-valley arbitrage model following the policy adjustments by integrating

Get Started

CAB1000: scalable, versatile power-conversion solution

3 days ago · Streamline the development of your utility-grade solar and energy storage systems with the CAB1000. This scalable solution offers modular 1.5 MW blocks that seamlessly

Get Started

power storage profit analysis design scheme epc

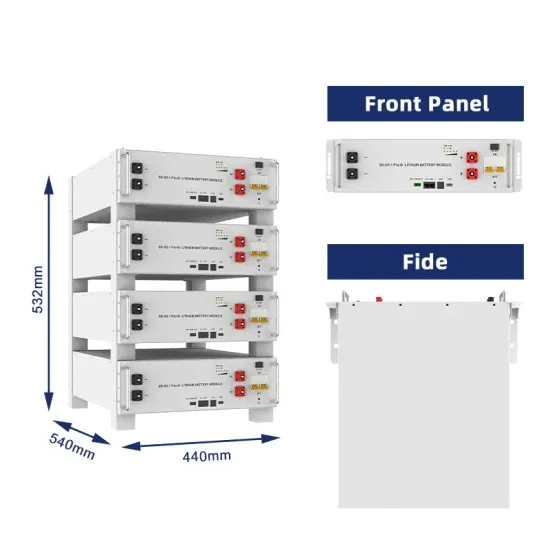

The BESS is rated at 4 MWh storage energy, which represents a typical front-of-the meter energy storage system; higher power installations are based on a modular architecture, which might

Get Started

Energy storage epc profit

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is

Get Started

summary of the analysis report on the profit model of energy storage

This paper studies the optimal operation strategy of energy storage power station participating in the power market, and analyzes the feasibility of energy storage

Get Started

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get Started

How is the profit of energy storage EPC | NenPower

Aug 16, 2024 · The profit of energy storage EPC is determined by various factors, including 1. project scale, 2. technology selection, 3. financing options, and 4. market dynamics.

Get Started

Two-stage robust transaction optimization model and

May 15, 2024 · Two-stage robust transaction optimization model and benefit allocation strategy for new energy power stations with shared energy storage considering green certificate and

Get Started

6 FAQs about [Energy Storage Power Station EPC Profit Model]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Related Articles

-

Profit model of Chad energy storage power station

Profit model of Chad energy storage power station

-

Kenya Mombasa Energy Storage Power Station Profit Model

Kenya Mombasa Energy Storage Power Station Profit Model

-

Energy Storage Power Station Cooperation Model

Energy Storage Power Station Cooperation Model

-

Huawei Energy Storage Power Station Business Model

Huawei Energy Storage Power Station Business Model

-

Poland portable emergency energy storage power station

Poland portable emergency energy storage power station

-

Huawei Energy Storage Power Station Data Access Solution

Huawei Energy Storage Power Station Data Access Solution

-

Steel Plant Application Energy Storage Power Station

Steel Plant Application Energy Storage Power Station

-

Kosovo Energy Storage Power Station Customization Company

Kosovo Energy Storage Power Station Customization Company

-

German power plant energy storage power station project

German power plant energy storage power station project

-

What is a wind power energy storage cabinet for a communication base station

What is a wind power energy storage cabinet for a communication base station

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.