Southeast Asia Uninterruptible Power Supply (UPS) Market

Jun 30, 2025 · The Southeast Asia Uninterruptible Power Supply (UPS) market is experiencing robust growth, driven by increasing electricity demand, rising adoption of data centers and

Get Started

Southeast Asia Uninterruptible Power Supply (UPS) Market

Feb 1, 2025 · Southeast Asia Uninterruptible Power Supply (UPS) Market by Capacity (Less than 10 kVA, 10-100 kVA, Above 100kVA), by Type (Standby UPS System, Online UPS System,

Get Started

东南亚不断电系统 (UPS) -市场占有率分析、产业趋势/统计

Jan 5, 2025 · The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include

Get Started

Three Phase Uninterruptible Power Supply: The

Three Phase Uninterruptible Power Supply: Essential for industrial and high-demand environments, three-phase UPS systems distribute power evenly,

Get Started

Modular UPS Market Size, Share And Growth

Jul 28, 2025 · The Asia-Pacific modular UPS market is expected to grow significantly, driven by strong investments in infrastructure and technology

Get Started

Southeast Asia Uninterruptible Power Supply (UPS)

Jan 5, 2025 · The Southeast Asia Uninterruptible Power Supply Market is expected to register a CAGR of greater than 3.3% during the forecast period. The market was moderately impacted

Get Started

Three-phase UPS Market Report | Global Forecast From 2025

As of 2023, the global market size for three-phase Uninterruptible Power Supply (UPS) systems is estimated at USD 9.1 billion, with a projected increase to USD 15.4 billion by 2032, reflecting a

Get Started

Southeast Asia Uninterruptible Power Supply (UPS)

Jan 5, 2025 · Southeast Asia Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) - The Southeast Asia

Get Started

Asia Pacific Commercial Uninterruptible Power Supply

Aug 5, 2025 · This report focuses on identifying opportunities and strategies for investing in the Asia Pacific commercial uninterruptible power supply (UPS) market within the forecast period.

Get Started

Southeast Asia Uninterruptible Power Supply

The Southeast Asia Uninterruptible Power Supply Market is expected to register a CAGR of greater than 3.3% during the forecast period. The market was

Get Started

Asia-Pacific Uninterruptible Power Supply (UPS) Market Size

Included in its product portfolio is the 9900D Three Phase UPS, a high-capacity uninterruptible power supply that distinguishes itself by featuring a more compact footprint in comparison to

Get Started

Three-Phase Uninterruptible Power Supply (UPS)

Three-Phase UPS Systems There is a wide variety of uninterruptible power supply systems (UPSs) optimized to provide backup power and stable voltage

Get Started

Southeast Asia Uninterruptible Power Supply

2 days ago · The Southeast Asia Uninterruptible Power Supply (UPS) market is a dynamic and rapidly growing industry in the region. UPS systems play a

Get Started

Uninterruptible Power Supply (UPS) Growth:

Nov 21, 2024 · The Uninterruptible Power Supply (UPS) Market is expected to reach USD 12.16 billion in 2025 and grow at a CAGR of 3.73% to reach USD

Get Started

Uninterruptible Power Supply (UPS) Philippines,

Uninterruptible Power Supply (UPS), NuPon Technology - Specializes in Contamination Control, Static Control, PPE, QA & Productivities Equipment &

Get Started

Analysis of the Southeast Asian Uninterruptible Power Supply (UPS

May 22, 2012 · This research service covers the current state and future potential of the UPS services market in Southeast Asia. It provides an in-depth analysis of the drivers, restraints

Get Started

Asia-Pacific Uninterruptible Power Supply (UPS)

The Asia-Pacific uninterruptible power supply (UPS) market is estimated to register a CAGR of 4.21% during the forecasted years 2022 to 2030,

Get Started

全球和地区三相 UPS 市场规模及预测

Three-phase UPS Market Segmentation Analysis The global Three-phase UPS market is divided into three segments product type, application and region. By type it is divided as online, offline,

Get Started

Southeast Asia Uninterruptible Power Supply (UPS)

The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Eaton

Get Started

Uninterruptible Power System

Global Uninterruptible Power System - UPS market size 2025 was XX Million. Uninterruptible Power System - UPS Industry compound annual growth rate (CAGR) will be XX% from 2025

Get Started

Uninterruptible Power Supply (UPS) Solutions

In the Ultron UPS family, three-phase online UPSs have power ratings of up to 4000 kVA, perfect for data centers, industrial facilities, and more. Three-Phase

Get Started

Top 8 Companies Singapore Ups Systems Market | 2025

As per 6Wresearch, Singapore uninterruptible power supply (UPS) systems market is highly competitive, with the presence of numerous major players who contribute to its growth and

Get Started

Asia-Pacific Three-phase UPS Market Assessment 2020-2026

In this report, the Three-phase UPS market is expected to be valued at USD xxx billion by 2026, growing at a CAGR of xx% between 2020 and 2026. In this study, sales and sales value

Get Started

Uninterruptible Power Supply (UPS) | Electrical

Galaxy VS is a highly efficient, modular, easy-to-deploy 10-150 kW three-phase uninterruptible power supply that delivers top performance to critical IT,

Get Started

Regenerative Uninterruptible Power Supply Ups Industry

Aug 14, 2025 · Vietnam Regenerative Uninterruptible Power Supply Ups Industry Research Report Market Vietnam''s emerging industrial sector and increasing digitalization drive the

Get Started

Asia Pacific Healthcare Uninterruptible Power Supply (UPS)

Apr 23, 2025 · Asia Pacific Healthcare Uninterruptible Power Supply (UPS) Market 2023-2033 by Product, Capacity, Phase Voltage, End User, and RegionOpportunity and Strategy Analysis

Get Started

Development of Uninterruptible Power Supply "SANUPS

Nov 21, 2018 · Up until now, Sanyo Denki has sold the single-phase, two-wire 5 kVA to 20 kVA small capacity UPS "SANUPS A11J" series to overseas buyers, however foreseeing an

Get Started

3 Phase Battery Backup Uninterruptible Power

3 Phase Power Conditioner, Voltage Regulator, & Battery Backup UPS Systems 3 phase battery backup uninterruptible power supply systems (UPS) provide 3

Get Started

Asia Pacific Commercial Uninterruptible Power Supply (UPS)

Mar 14, 2025 · Asia Pacific Commercial Uninterruptible Power Supply (UPS) Market 2023-2033 by Product, Capacity, Form Factor, Phase Voltage, End User, and RegionOpportunity and

Get Started

6 FAQs about [Southeast Asia Three-phase Uninterruptible Power Supply Purchase]

How is the Southeast Asian uninterruptible power supply market segmented?

The Southeast Asian uninterruptible power supply (UPS) market is segmented by capacity, type, application, and geography. By capacity, the market is segmented into less than 10 kVA, 10-100 kVA, and above 100 kVA. The market is segmented by type into standby UPS systems, online UPS systems, and line-interactive UPS systems.

How competitive is Singapore uninterruptible power supply (UPS) system market?

As per 6Wresearch, Singapore uninterruptible power supply (UPS) systems market is highly competitive, with the presence of numerous major players who contribute to its growth and development. Key players are constantly investing in research and development to introduce new and advanced products and improve their existing offerings.

What are the key factors affecting the Southeast Asia UPS market?

The Southeast Asia UPS market is highly competitive and dynamic. Several factors influence its growth, including technological advancements, government regulations, and market trends. The market is characterized by intense competition among key players, who are continuously striving to develop innovative and cost-effective UPS solutions.

What is the Southeast Asia UPS market?

The Southeast Asia UPS market can be divided into several key regions, including Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines. These countries are witnessing rapid economic growth and increased investments in various sectors, driving the demand for UPS systems. Competitive Landscape

What is the demand for ups in Southeast Asia?

Demand from Emerging Economies: Countries such as Vietnam, Indonesia, and the Philippines are witnessing rapid economic growth and urbanization. This creates a significant demand for UPS systems as industries and infrastructure projects expand. Market Dynamics The Southeast Asia UPS market is highly competitive and dynamic.

How will Vietnam's ups market change in 2024?

Building works for Phase II are expected to begin in 2024. Such growth and investments in Vietnam indicate the rise in the manufacturing sector, which in turn, is expected to increase the demand for UPS systems during the forecast period. The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature.

Related Articles

-

Canadian Uninterruptible Power Supply Purchase EK

Canadian Uninterruptible Power Supply Purchase EK

-

East Asia quality UPS uninterruptible power supply agent

East Asia quality UPS uninterruptible power supply agent

-

Canberra Small Uninterruptible Power Supply Purchase

Canberra Small Uninterruptible Power Supply Purchase

-

Mauritius backup UPS uninterruptible power supply quotation

Mauritius backup UPS uninterruptible power supply quotation

-

Uninterruptible power supply manufacturer recommendation

Uninterruptible power supply manufacturer recommendation

-

Large uninterruptible power supply for factories

Large uninterruptible power supply for factories

-

Nairobi ups uninterruptible power supply factory

Nairobi ups uninterruptible power supply factory

-

Huawei Tehran UPS Uninterruptible Power Supply

Huawei Tehran UPS Uninterruptible Power Supply

-

Power transmission sequence of uninterruptible power supply for mine

Power transmission sequence of uninterruptible power supply for mine

-

How much does a Ukrainian UPS uninterruptible power supply cost

How much does a Ukrainian UPS uninterruptible power supply cost

Commercial & Industrial Solar Storage Market Growth

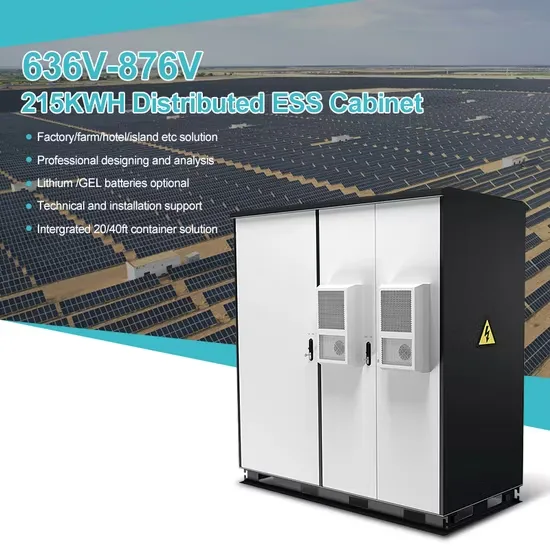

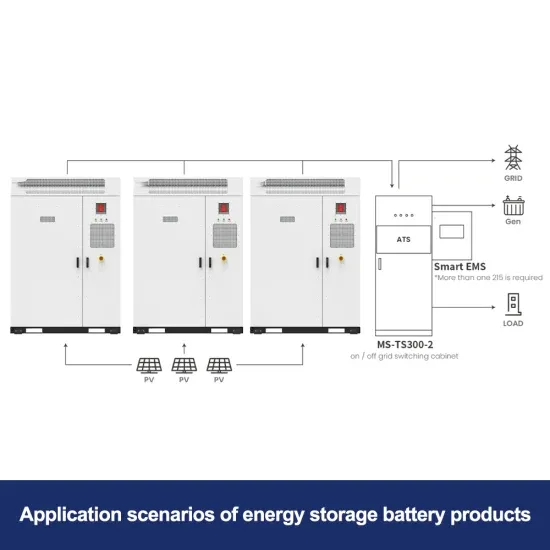

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.