Middle East and Africa Cylindrical Ternary Lithium Battery

Jul 4, 2025 · The cylindrical ternary lithium battery market in the Middle East and Africa (MEA) region is experiencing dynamic growth, driven by a blend of industrialization trends, rising

Get Started

HCC Ships Lithium Batteries for Middle East

On April 3, 2024, Beijing time, Topway Battery (HCC) completed the bulk shipment of lithium batteries to customers in the Middle East market as scheduled, including digital batteries, tool

Get Started

Middle East and Africa Lithium Battery Grinder Market

Jul 5, 2025 · The Middle East and Africa lithium battery grinder market is witnessing substantial growth, propelled by increasing demand for lithium-ion battery components in electric vehicles

Get Started

Battery Storage in the Middle East: Powering the Energy Shift

Jul 16, 2025 · According to The Future of Battery Market in the Middle East & Africa, Saudi Arabia plans to expand its battery storage capacity from 22 GWh to 48 GWh by 2030. The Saudi

Get Started

Middle East and Africa Lithium-Ion Battery Recycling Market

Middle East and Africa Lithium-Ion Battery Recycling Market Analysis and Size The lithium-ion battery recycling market plays a vital role in sustainability efforts by recovering valuable

Get Started

Comprehensive Middle East and Africa Lithium Ion Battery

Discover the latest trends, growth drivers, demand forecasts, and performance insights for the Middle East and Africa Lithium Ion Battery market. Explore key factors shaping the future of

Get Started

Custom-Fit Battery Solution Boosts Uptime For Middle East

Jun 19, 2025 · Through close consultation, BSLBATT delivered a custom-engineered lithium battery system, optimized for heat resistance and high-current output. The selected battery

Get Started

Middle East and Africa Lithium Market

May 15, 2025 · However, the increasing production of lithium-ion batteries and the steady improvement of battery performance achieved through sustained R&D

Get Started

Middle East and Africa Lithium Batteries for Electric Ships

Jul 5, 2025 · Middle East and Africa Lithium Batteries for Electric Ships Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR

Get Started

7 Best LiFePO4 Batteries Engineered for Middle East Desert

Jun 12, 2025 · 7 Best LiFePO4 Batteries for Middle East Deserts (2025): Beat Extreme Heat & Sandstorms Average summer temperatures exceeding 50°C, frequent sandstorms, and

Get Started

The Rise of MENA: Saudi Arabia & Morocco''s

4 days ago · Saudi Arabia and Morocco are making head way in the race to secure a foothold in the global lithium-ion battery supply chain. By leveraging

Get Started

Middle East Battery Industry 2025-2033 Analysis: Trends,

Jul 1, 2025 · The forecast period suggests continued growth, emphasizing the Middle East''s emerging role as a significant player in the global battery market. This comprehensive report

Get Started

Top 10 Companies in the Middle East Performance Lithium

Jun 10, 2025 · In this analysis, we profile the Top 10 Companies dominating the Middle East Performance Lithium Compounds Market —global lithium producers, regional chemical

Get Started

The lithium rush: How the UAE and Saudi Arabia are racing

Sep 16, 2024 · "Local production of lithium batteries is a key enabler for the energy transition and scaling of EV adoption in the Middle East by ensuring a stable and timely supply chain for

Get Started

Middle East and Africa Battery Market 2025-2034

Jul 2, 2025 · The MEA battery market refers to the industry involved in the production, distribution, and utilization of batteries within the Middle East and Africa regions. Batteries are portable

Get Started

MK ENERGY at Middle East Energy 2025:

Feb 28, 2025 · MK ENERGY is excited to participate in Middle East Energy 2025, taking place from April 7-9 in Dubai. As a leading battery manufacturer, we will

Get Started

Middle East and Africa Lithium-ion Battery Market, By Type ;

Sep 1, 2023 · Middle East and Africa Lithium-ion Battery Market Size Set to Touch USD 972 Million by 2029. Middle East and Africa Lithium-ion Battery market is gaining traction because

Get Started

Middle East and Africa Motorcycle Lithium Battery Market

Jul 5, 2025 · Middle East and Africa Motorcycle Lithium Battery Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of

Get Started

Middle East Lithium Market Size, Share | Industry Report 2033

Aug 13, 2025 · The Middle East lithium market size was estimated at USD 84.3 million in 2024 and is expected to reach USD 747.9 million in 2033, growing at a CAGR of 16.0% from 2025

Get Started

Middle East And Africa Lithium-ion Battery For Electric

Feb 12, 2025 · The Middle East and Africa Lithium-ion Battery for Electric Vehicle Market is projected to grow from USD 0.58 million in 2023 to USD 2.41 million by 2033, at a CAGR of

Get Started

Middle East And Africa Lithium-ion Battery For Electric Vehi

Middle East And Africa Lithium-ion Battery For Electric Vehicle Market Valuation – 2026-2032 Growing domestic battery production and strategic investments in localized supply chains

Get Started

Middle East And Africa Lithium-ion Battery For Electric

Jan 5, 2025 · The Middle East And Africa Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 0.69 billion in 2025, and is expected to reach USD 1.71 billion by 2030, at a

Get Started

Middle East and Africa Lithium-Ion Battery

The global Middle East and Africa Lithium-Ion Battery Recycling size was valued at USD 108.33 Million in 2025 and is projected to reach USD 528.18 Million by

Get Started

Middle-East Battery Market Size | Mordor

Feb 20, 2025 · Middle East Battery Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Middle East Battery Market report

Get Started

6 FAQs about [Middle East lithium battery customization]

What is the market size of lithium in Middle-East and Africa?

The market for Lithium in Middle-East and Africa is expected to grow at a CAGR of over 10% during the forecast period. Major factors driving the market studied are accelerating demand for electric vehicles and growing usage and demand from the portable consumer elctronics.

Who are the key players in the Middle-East and Africa lithium market?

The Middle-East and Africa Lithium market is consolidated, with the top five players accounting for major share of the market. The key players in the market include, Albemarle Corporation, SQM S.A., Tianqi Lithium, Orocobre Limited Pty Ltd, and FMC Corporation.

Which country is expected to dominate the lithium market?

By application, battery segment is expected to account for the largest share owing to increasing usage of lithium for the production of lithium batteries. By Country, Saudi Arabia is expected to dominate the market during the forecast period. The Middle-East and Africa Lithium market report includes:

What are the opportunities for the lithium recycling market?

Recycling of lithium and its batteries is expected to offer various lucrative opportunities for the growth of market. By application, battery segment is expected to account for the largest share owing to increasing usage of lithium for the production of lithium batteries.

What is lithium used for?

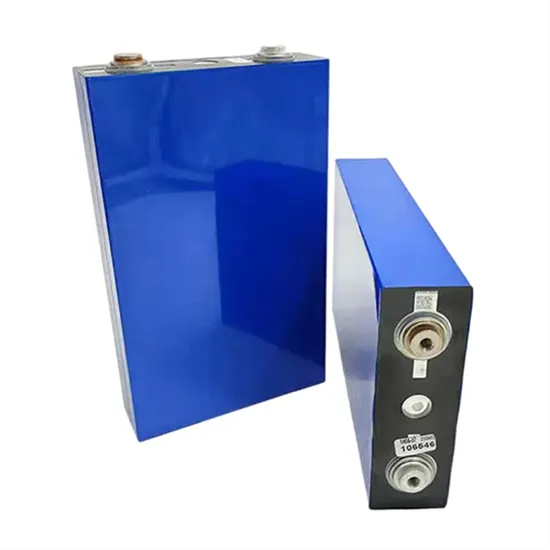

Lithium is majorly used in battery applications for the production of lithium batteries. The battery application segment accounted for the largest share of the Middle-East and North Africa lithium market in 2019. Lithium batteries can be categorized into two segments, namely, disposable and rechargeable.

What are the different types of lithium batteries?

Lithium batteries can be categorized into two segments, namely, disposable and rechargeable. Disposable lithium batteries use lithium in the metallic form as an anode. These batteries have a long life (high charge density) when compared to other standard batteries.

Related Articles

-

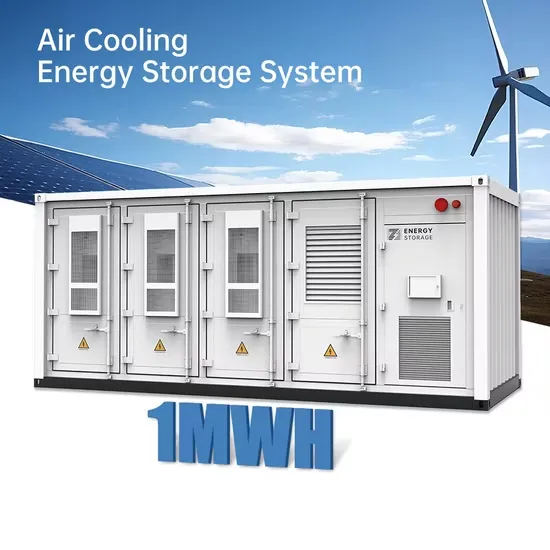

Middle East lithium battery water cooling system

Middle East lithium battery water cooling system

-

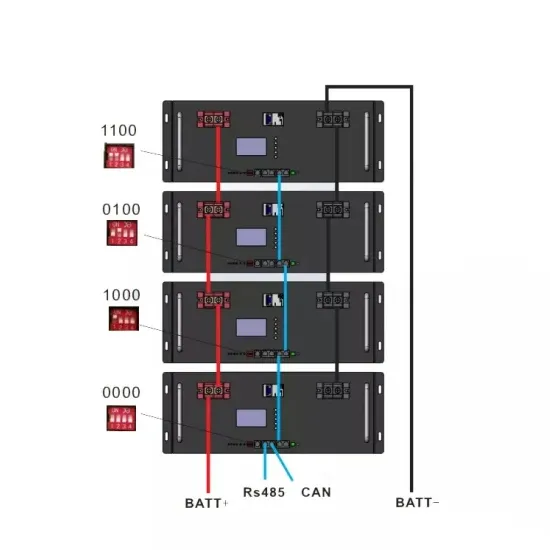

Middle East lithium energy storage battery series connection method

Middle East lithium energy storage battery series connection method

-

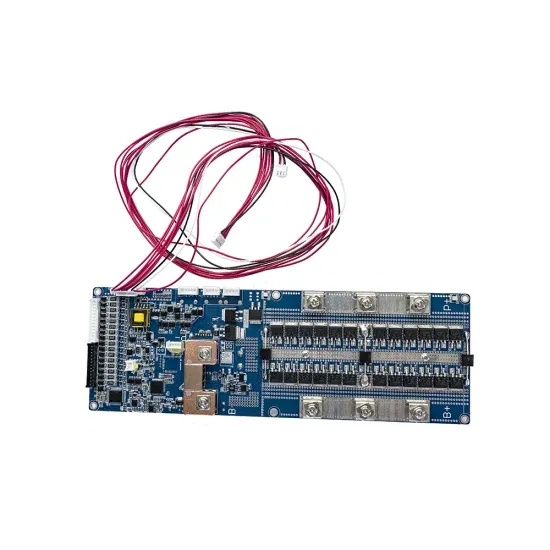

Middle East lithium battery bms merchants

Middle East lithium battery bms merchants

-

Lobamba lithium battery pack customization

Lobamba lithium battery pack customization

-

Port Moresby lithium battery customization

Port Moresby lithium battery customization

-

Somaliland lithium battery station cabinet customization company

Somaliland lithium battery station cabinet customization company

-

Azerbaijan cylindrical lithium battery customization

Azerbaijan cylindrical lithium battery customization

-

Czech lithium battery pack customization

Czech lithium battery pack customization

-

Sukhumi energy storage lithium battery customization

Sukhumi energy storage lithium battery customization

-

Latvian lithium battery outdoor power supply customization

Latvian lithium battery outdoor power supply customization

Commercial & Industrial Solar Storage Market Growth

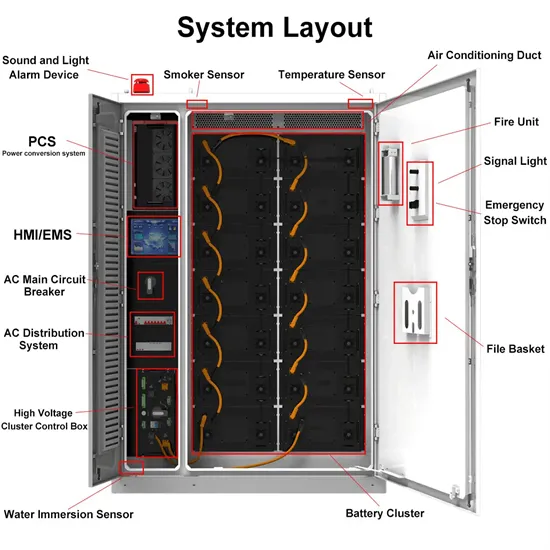

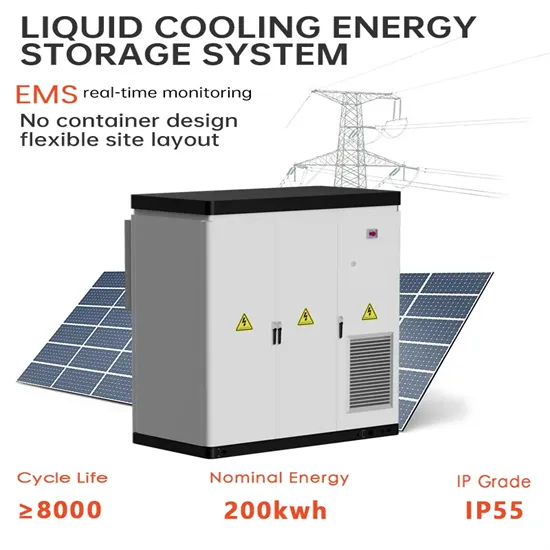

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.