European Negative Power Prices Highlight Merchant Projects

Mar 28, 2025 · A surge in renewable buildout in recent years – combined with inflexible conventional power generation, such as nuclear energy, and insufficient interconnections and

Get Started

Feed-in Tariff vs Tolling Agreements in U.S. Energy Storage

Aug 14, 2025 · A comprehensive look at feed-in tariffs vs. tolling agreements for energy storage developers and offtakers: analyzing revenue certainty, market exposure, and risk allocation

Get Started

Price impact assessment for large-scale merchant energy storage

Apr 15, 2017 · From a consumer''s perspective, the storage reduces the average of wholesale prices. The changes in the revenue of generation units vary and depend on their bidding

Get Started

Merchant risk management in the renewable

Nov 12, 2018 · If stakeholders move away from subsidizing the renewable-energy market, developers would be exposed to wholesale prices. Renewables

Get Started

Ormat signs California BESS agreement in shift

Jul 25, 2024 · A 2023 ribbon-cutting to inaugurate an Ormat BESS project in Bowling Green, Ohio, US. Image: Ormat Technologies. US renewable energy

Get Started

The Real Cost of Commercial Battery Energy

Apr 21, 2025 · With fluctuating energy prices and the growing urgency of sustainability goals, commercial battery energy storage has become an

Get Started

India''s Merchant Battery Storage Market Turns Profitable Amid Price

Aug 5, 2025 · In a marked departure from years of cautious optimism, merchant battery energy storage systems (BESS) in India have turned profitable. According to a new report from

Get Started

Economic dispatch for electricity merchant with energy storage

Sep 1, 2022 · For a storage-and-renewable energy source electricity merchant, we identify analytically three SOC reference points that rely on the currently available energy inventory in

Get Started

Sizing Merchant Energy Storage for Maximum

Jan 1, 2023 · As prices for energy storage (ES) decline, merchant-owned ES units have an opportunity to be profitable if they earn revenue from multiple

Get Started

The Real Cost of Commercial Battery Energy

Apr 21, 2025 · In 2025, the typical cost of a commercial lithium battery energy storage system, which includes the battery, battery management system

Get Started

Energy Storage Pricing Insights

Rank energy storage system options by total lifecycle cost, including CapEx, OpEx, preventative maintenance, warranties, and augmentation. Iterate through hundreds of configurations to

Get Started

Worldwide Merchant Electricity Prices – Edward

You can also study fascinating cases including the California crisis, the crash in UK prices leading to bankruptcies of every plant that was purely merchant;

Get Started

BESS are becoming more attractive – pv

Nov 23, 2024 · Falling prices and rising revenues are strengthening the business case for merchant energy storage going forward. But that may not translate

Get Started

Unraveling the complexity of merchant energy storage projects

Figure 3: Illustrative inputs into cash flow models for power plants and storage projects Read part 2 of this series: 7 Lessons Learned from Merchant Energy Storage Projects. You can also

Get Started

Hedging Strategies to Optimize Merchant Energy Porfolio

Jul 4, 2025 · Physical and Financial Hedging Strategies for Renewables and Storage When thinking about hedging strategies for renewables and storage, weather becomes a primary

Get Started

Falling Battery Costs, Volatile Prices Make Merchant BESS

Aug 5, 2025 · Battery energy storage systems (BESS) operating without fixed contracts – known as merchant BESS – turned profitable for the first time in 2024. These projections were shared

Get Started

Merchant storage: How predictable is energy arbitrage

Jul 23, 2025 · Merchant storage: How predictable is energy arbitrage revenue? To effectively operate a merchant energy storage project, you need to forecast energy prices. While storage

Get Started

Sizing Merchant Energy Storage for Maximum Revenues

Jan 20, 2025 · ABSTRACT As prices for energy storage (ES) decline, merchant-owned ES units have an opportunity to be profitable if they earn revenue from multiple streams. Most papers in

Get Started

Tolling agreements and floor pricing for BESS

Dec 12, 2023 · This article explores tolling agreements and floor prices for battery systems in an interview with storage specialist Andras Molnar. For a complete overview of all revenue

Get Started

The Rise of Distributed Generation Tariffs in ERCOT

Mar 25, 2025 · In the past year, a number of utilities in ERCOT, which has seen 1,511MW of storage added to the grid in 2024 alone, implemented tariffs on

Get Started

[Energy Storage News] ''Foundational'' market

Mar 19, 2025 · There will be ''foundational'' shifts in the US'' two largest renewables and energy storage markets this year, California (CAISO) and Texas

Get Started

Energy storage EPC prices continue to decline in China, with

May 14, 2024 · The lowest EPC price for energy storage in China in May 2024 was 0.96 yuan/Wh, while the average bid price for lithium iron phosphate (LFP) energy storage EPC was 1.35

Get Started

Merchant Risk in Power Projects

May 17, 2022 · Independent power producers are increasingly selling generated energy into the wholesale market on a merchant basis rather than relying on fixed-price contracts or

Get Started

Energy Storage System Price Trends and Cost-Saving

Over the past 3 years, the average energy storage system price has dropped by 28% worldwide. What''s driving this downward trend? Technological breakthroughs in lithium-ion batteries,

Get Started

Reflections from the Energy Storage Summit

Apr 10, 2025 · How battery optimisation is evolving to maximise merchant revenues amid rising price volatility, insights from the Energy Storage Summit.

Get Started

7 Lessons learned from merchant energy storage projects

Apr 20, 2020 · Average price levels are important, but low, base, and high revenue scenarios should focus on changing market dynamics (e.g. varying amounts of renewable penetration —

Get Started

Merchant battery storage operations in India became

Aug 5, 2025 · Battery energy storage systems (BESS) operating without fixed contracts or merchant BESS, turned profitable in India for the first time in 2024, according to a new report

Get Started

An update on merchant energy storage

Nov 17, 2021 · Energy Pricing Risk: Like other resources, storage resources face commodity price risks based on market pricing trends over time driven by new resource additions, retirements,

Get Started

Electricity Trading and Negative Prices: Storage vs. Disposal

Aug 26, 2015 · Electricity cannot yet be stored on a large scale, but technological advances leading to cheaper and more efficient industrial batteries make grid-level storage of electricity

Get Started

Utility-Scale Battery Storage | Electricity | 2024 | ATB | NREL

The battery storage technologies do not calculate levelized cost of energy (LCOE) or levelized cost of storage (LCOS) and so do not use financial assumptions. Therefore, all parameters are

Get Started

Ultra-low cost battery storage launch provokes

5 days ago · A product launch at EESA Energy Storage Exhibition in China drew attention, discussion of price war and even disbelief, reports Carrie Xiao.

Get Started

6 FAQs about [Merchant energy storage prices]

How much does energy storage cost?

Let's analyze the numbers, the factors influencing them, and why now is the best time to invest in energy storage. $280 - $580 per kWh (installed cost), though of course this will vary from region to region depending on economic levels. For large containerized systems (e.g., 100 kWh or more), the cost can drop to $180 - $300 per kWh.

How risky is a merchant storage project?

Merchant storage projects are complex, but the risks can be measured and managed with appropriate planning and analysis. Merchant markets are evolving quickly all over the world, many being intentionally designed to incorporate more energy storage.

Is merchant storage difficult?

Merchant storage is complicated, but not impossible As the storage market evolves, we see projects with an increasing proportion of their revenue expected to come from the merchant market rather than firm contracts. Just a few years ago it was the opposite.

Will merchant storage investment opportunities become more attractive in the future?

asingly critical role in the future. Thus far, most storage developments have been utility-owned or backed by long-term contracts, but merchant storage investment opportunities may become more attractive as the markets evolve and investors become comfortable w th the value stacking opportunities.In 2019, CRA published an Insights1 on

Why should merchant investors invest in ES units?

The relative proportion of revenue streams available to ES units in the energy and reserve markets will affect the willingness of the merchant investor to invest in ES units and will have a bearing on the optimal ES siting and sizing decisions.

Should paired merchant storage projects be compared to standalone storage?

The tradeoffs should be quantified when considering renewable paired merchant storage projects versus standalone storage. Batteries that are DC connected to solar charging facilities may have discharging limitations during periods of time when the solar is producing due to constraints of the shared inverter.

Related Articles

-

Current prices of energy storage equipment

Current prices of energy storage equipment

-

Benin energy storage product prices

Benin energy storage product prices

-

Lesotho electricity prices and energy storage

Lesotho electricity prices and energy storage

-

Nicaragua PV Energy Storage Wholesale Prices

Nicaragua PV Energy Storage Wholesale Prices

-

Romania lead-acid energy storage battery prices

Romania lead-acid energy storage battery prices

-

Cote d Ivoire energy storage equipment prices

Cote d Ivoire energy storage equipment prices

-

Bulgaria energy storage equipment prices

Bulgaria energy storage equipment prices

-

World s current energy storage equipment and prices

World s current energy storage equipment and prices

-

Energy storage prices in Ireland

Energy storage prices in Ireland

-

Moldova household energy storage battery prices

Moldova household energy storage battery prices

Commercial & Industrial Solar Storage Market Growth

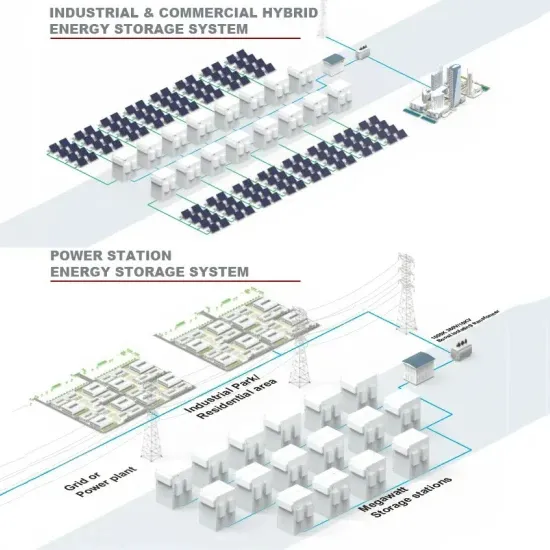

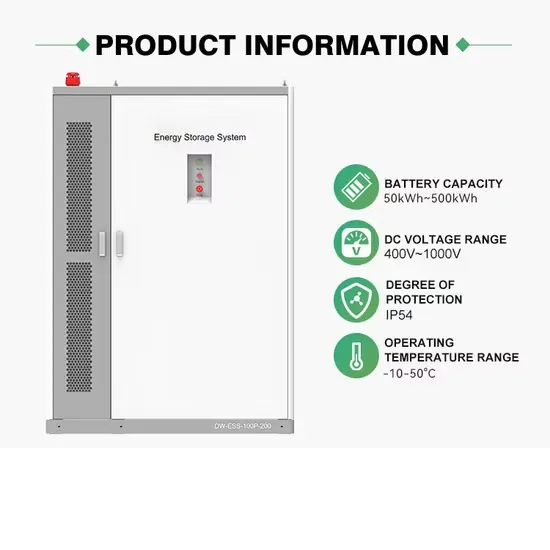

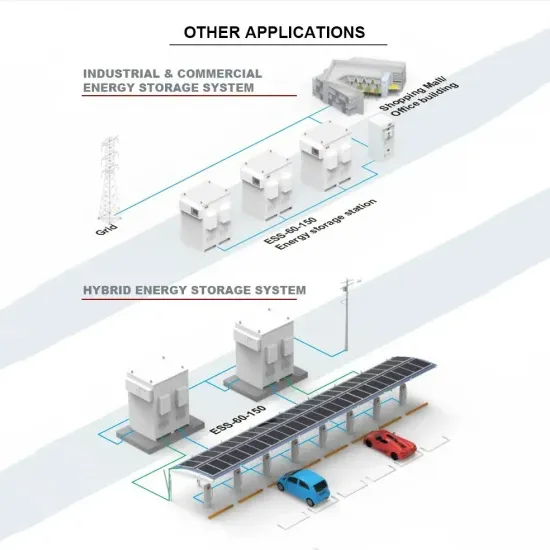

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.