Global and China Photovoltaic Inverter Industry Report, 2017

With a rapid rise in demand from downstream sectors, the global shipments of PV inverters was estimated to be 105GW in 2017, an upsurge of 55.6% on an annual basis; and the world

Get Started

Top 10 Solar Inverter Manufacturers In The

Jun 25, 2024 · Growatt, is the first batch of domestic layout of light storage and business globalization layout of enterprises, is the world''s top ten inverter

Get Started

Top 10 Global Shipments of Solar Modules in

Nov 19, 2024 · PVTIME – In terms of shipments in the first three quarters of 2024, there should be no suspense in the top 10 list of global PV module shipments,

Get Started

Global surge in solar PV inverter shipments highlights

Global solar PV inverter* shipments grew by 56% in 2023 to 536 GWac, with China accounting for half of all shipments as the country''s solar demand doubled in 2023, according to the latest

Get Started

Global PV inverter market share rankings by

Nov 19, 2024 · 光伏逆变器出货量持续增长,2023 年全球出货市占率排名第四。 上能电气在全球建有江苏无锡、宁夏吴忠、印度班加罗尔三大生产基地,过去 5 年公司光伏逆变器出货量持续

Get Started

Sungrow Keeps No.1 in 2022 Global PV Inverter Shipment,

Jul 6, 2023 · S&P Commodity Insights estimates that Sungrow was ranked the number one PV inverter supplier globally in shipment terms in 2022 with 77GWac of PV inverters shipped.

Get Started

PV inverter market share globally by shipments

Jul 9, 2025 · In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market.

Get Started

Top 10 Hybrid Inverter Manufacturers in China

Jan 17, 2025 · The company is mainly engaged in the R&D, production, sales, and service of string inverters, which are the core equipment of distributed

Get Started

Global Solar PV Inverter State of the Market 2024

Sep 6, 2024 · Report Summary: This new annual report provides insight into the global and regional PV inverter markets, presenting a detailed breakdown of 2023 shipments by product

Get Started

Top five!Chint power has won the 365 global

On June 10, the "2022 global photovoltaic top 20 ranking" initiated and held by 365 photovoltaic, 365 energy storage and smart energy was officially released

Get Started

Global PV inverter shipments increased to more than 330

The top five vendors, Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe, shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8%

Get Started

Solis Ranks in 2024 Global Top 500 New Energy Enterprises

Sep 27, 2024 · During the 2024 Taiyuan Energy Low Carbon Development Forum, Solis was once again recognized as one of the "2024 Global Top 500 New Energy Enterprises." For the

Get Started

Global and China Photovoltaic Inverter

Feb 22, 2018 · After high-speed growth in 2017, the global newly installed PV capacity is expected to stabilize at 85GW or so over the next couple of years, which will cause fluctuations of PV

Get Started

InfoLink''s 2024 global module shipment ranking: significant

Feb 18, 2025 · The shipment data for this ranking was based on InfoLink''s database and surveys conducted with manufacturers. If the statistics for a certain manufacturers are not fully

Get Started

Global Solar Inverter Shipments Grew By 56%:

Aug 9, 2024 · Globally, PV inverter shipments have witnessed a 56% rise to reach 536 gigawatts of alternating current (GWac) in 2023, indicating strong

Get Started

Top 10 solar PV inverter vendors cornered 86

Sep 19, 2023 · Our latest ''Global Solar PV Inverter and Module-Level Power Electronics Market Share 2023'' report reveals a buoyant market in 2023, with

Get Started

In the global PV inverter shipment 185GW in

Sep 6, 2021 · According to Wood Mackenzie''s "2020 global PV inverter supplier market rankings" released in June, global PV inverter shipments surged to

Get Started

Top five solar inverter vendors accounted for

Aug 14, 2023 · Wood Mackenzie noted that the top five vendors shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments

Get Started

A year of time shipments reached the size of 1GW, row

According to the "2013 China PV Inverter Market Report", 2013来 from China''s inverter enterprise shipments exceeded 13GW, accounting for the global market share rose to 26%. Among

Get Started

In 2025, China''''s Photovoltaic Inverter Industry Market

Dec 30, 2024 · Photovoltaic inverters are one of the balance of systems (BOS) of photovoltaic inverters in photovoltaic array systems and can be used with general AC-powered equipment.

Get Started

Global solar PV inverter shipments | Statista

Jul 14, 2025 · In 2024, global solar PV inverter shipments reached 589 gigawatts alternating current. Since 2018, inverter shipments worldwide have increased by almost 480 gigawatts.

Get Started

Global and China Photovoltaic Inverter Industry

Apr 26, 2022 · PV inverters are divided into on-grid inverters and off-grid inverters. In 2015, the global PV inverter shipment hit 56.0GW, a year-on-year

Get Started

AISWEI Tops Wood Mackenzie''s Global Residential Inverter Shipment

Jul 27, 2025 · Recently, Wood Mackenzie, a leading global research authority in renewable energy, energy, and natural resource markets, officially released the 2024 global PV inverter

Get Started

Forecast and analysis of China''s PV inverter shipments and enterprise

Jul 5, 2024 · According to the "2024-2029 China Photovoltaic Inverter Industry Market Prospect Forecast and Future Development Trend Report" released by the China Commercial Industry

Get Started

Global Renewable Energy Market Booms, China''s

Jan 17, 2025 · To help relevant departments and PV stakeholders understand the true situation of industry development, Solarbe & Solarbe Consulting, after

Get Started

Who are the top five photovoltaic inverter shipments in 2021

Wood Mackenzie''s report says that at present, the consolidation of the head inverter enterprise is continuing. In 2021, the world''s top 10 solar PV inverter suppliers accounted for 82% of the

Get Started

Forecast and analysis of China''s PV inverter shipments and enterprise

Jul 5, 2024 · Photovoltaic inverter is one of the core components of the photovoltaic power generation system, and its role is to convert the direct current emitted by the solar cell into

Get Started

Top 10 solar PV inverter vendors account for

Aug 14, 2023 · The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total

Get Started

Solar Photovoltaic Inverter Enterprise

The global PV demand of 201 gigawattalternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments,strong growth in

Get Started

Analysis of Market Status and Competition Pattern of Global PV Inverter

The core data of this article: Global PV inverter shipments, global PV inverter market competition pattern 1. Global PV Inverter Development Inverters first appeared in the late 19th century, and

Get Started

PHOTOVOLTAIC MODULES AND INVERTERS

Mar 5, 2025 · The different inverter types available in the market are central inverters, string inverters, micro inverters, smart inverters and battery-based inverters. Central inverters are

Get Started

2023 World''s Top 20 Global Photovoltaic

May 25, 2023 · PVTIME – Cohesion of PV brands promotes strong development of technology and services for solar energy and energy storage industry. On

Get Started

Analysis of Market Status and Competition Pattern of Global PV Inverter

May 31, 2024 · The core data of this article: Global PV inverter shipments, global PV inverter market competition pattern 1. Global PV Inverter Development Inverters first appeared in the

Get Started

Sungrow Holds the Global No. 1 Position in PV Inverter Shipments

HEFEI, July 11, 2024 - Sungrow, the global leading PV inverter and energy storage system provider, secured the top spot in the 2023 global PV inverter shipment rankings according to

Get Started

Leading enterprise of energy storage photovoltaic inverter

The top five vendors - Huawei,Sungrow,Ginlong Solis,Growatt,and GoodWe - shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022,growing 8%

Get Started

6 FAQs about [Photovoltaic inverter enterprise shipments]

How did global PV inverter shipments grow in 2023?

Global PV inverter shipments grew by 56% to 536 gigawatts alternating current (GWac) in 2023, reflecting a strong year for the broader solar industry. The top 10 global PV inverter vendors accounted for 81% of the market.

What is the global PV inverter market share?

Global PV inverter shipments grew by 56% to 536 gigawatts alternating current (GWac) in 2023, reflecting a strong year for the broader solar industry. The top 10 global PV inverter vendors accounted for 81% of the market, according to Wood Mackenzie’s ‘ Global solar inverter and module-level power electronics market share 2024’ report.

What is the global solar PV inverter market like in 2023?

Global solar PV inverter* shipments grew by 56% in 2023 to 536 GWac, with China accounting for half of all shipments as the country’s solar demand doubled in 2023, according to the latest analysis by Wood Mackenzie. The top 10 PV inverter vendors, led by Chinese giants Huawei and Sungrow, controlled 81% of the global market.

Which PV inverter vendors shipments grew the most in 2022?

The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8% from 2021. Huawei’s shipments saw a significant increase of 83% in 2022 compared to 2021, while Sungrow’s shipments expanded 56% in the same period.

What is the global demand for PV inverters in 2022?

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022.

Why did solar inverter shipments surge 56% in 2023?

Globally, PV inverter shipments have witnessed a 56% rise to reach 536 gigawatts of alternating current (GWac) in 2023, indicating strong Solar inverter shipments surged by 56%, reaching 536 Gigawatts (GW) of alternating current (GWac) in 2023, reflecting robust growth in the solar industry, a latest report from Wood Mackenzie said.

Related Articles

-

Harare Photovoltaic Inverter Enterprise

Harare Photovoltaic Inverter Enterprise

-

Enterprise Photovoltaic Power Inverter

Enterprise Photovoltaic Power Inverter

-

Sucre photovoltaic energy storage 15kw inverter enterprise

Sucre photovoltaic energy storage 15kw inverter enterprise

-

Photovoltaic inverter io board function

Photovoltaic inverter io board function

-

Beijing photovoltaic off-grid inverter

Beijing photovoltaic off-grid inverter

-

8000w photovoltaic inverter

8000w photovoltaic inverter

-

Photovoltaic inverter SOLAX

Photovoltaic inverter SOLAX

-

What are the systems of communication base station inverter grid-connected photovoltaic power generation

What are the systems of communication base station inverter grid-connected photovoltaic power generation

-

Bogota photovoltaic panel inverter manufacturer

Bogota photovoltaic panel inverter manufacturer

-

Cairo Solar Photovoltaic Panel Inverter

Cairo Solar Photovoltaic Panel Inverter

Commercial & Industrial Solar Storage Market Growth

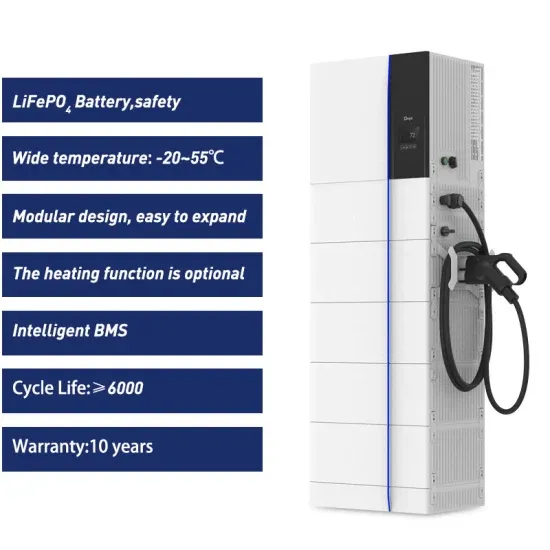

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.