Lithium Americas Reports Third Quarter 2024 Results

Sep 30, 2024 · (All amounts in US$ unless otherwise indicated) Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (" Lithium Americas " or the " Company ") has reported its financial and

Get Started

SIGMA LITHIUM REPORTS 3Q 2023 RESULTS; POSTING 37

Nov 14, 2023 · THIRD QUARTER 2023 AND RECENT HIGHLIGHTS ($ USD) Sigma Lithium reported third-quarter revenue of USD $97 million, marking the Company''s first revenue

Get Started

Q3 FISCAL 2024

Oct 23, 2024 · QSE-5 represents an important milestone for our company and the battery industry as a whole. These cells are, to the best of our knowledge, the first anode-free solid-state

Get Started

Ford From the Road

Jun 23, 2025 · There''s a lot to uncover about Ford and its customers, fans, and enthusiasts. We hit the road to find these stories and the interesting people

Get Started

Lithium Performance Drives AMG to All-time Record Earnings

Nov 3, 2022 · Net income attributable to shareholders for the third quarter of 2022 was $68 million, yielding $2.09 diluted earnings per share, compared to $0.02 diluted loss per share in

Get Started

Looking at the third quarter report of the energy storage

Nov 2, 2024 · The reason for the loss, Tianqi Lithium said was related to the significant year-on-year decline in the performance of its associate company SQM in the third quarter of 2024,

Get Started

E3 Lithium

E3 Metals is a lithium company with the goal of producing lithium products to power the growing electrical revolution. Based in Alberta, E3 Metals is developing the Clearwater Project on the

Get Started

Lithium battery material stock Lianchuang shares profit

Oct 27, 2021 · Following the first year-on-year turnaround from a year-on-year profit in the middle of the report, the net profit of Lianchuang Shares in the first three quarters increased by more

Get Started

One article to understand the current situation of the power battery

Nov 7, 2023 · The curtain on the performance of the third quarter report has come to an end, and the "report card" handed over by the new energy power battery industry chain, which has

Get Started

Li-Cycle Reports Third Quarter 2024 Operational and

TORONTO, ONTARIO (November 7, 2024) – Li-Cycle Holdings Corp. (NYSE: LICY) ("Li-Cycle" or the "Company"), a leading global lithium-ion battery resource recovery company, today

Get Started

Next Generation Anodes for Lithium-Ion Batteries

Feb 24, 2025 · Therefore, it is important to gain in -depth understanding of the performance of PAA based binders and evolving these binders towards desired cell performance for silicon

Get Started

36氪_让一部分人先看到未来

Oct 23, 2024 · From the revenue side, in 2024Q3, CATL recorded a revenue of 92.278 billion yuan, a year-on-year decrease of 12.48%. Among them, the battery revenue was 80.9 billion

Get Started

American Battery Technology Company Reports Tripling of

May 16, 2025 · American Battery Technology Company (ABTC) announced significant growth in its fiscal third quarter of 2025, tripling its quarterly revenue to $1 million, primarily from recycled

Get Started

Lithium Americas Reports Third Quarter 2024 Results

Sep 30, 2024 · VANCOUVER, British Columbia-- (BUSINESS WIRE)-- Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (" Lithium Americas " or the " Company ") has reported its financial

Get Started

QUARTERLY REPORT

Apr 5, 2023 · The application lodged for an exploration drilling program in Zone 2 awaits Austrian mining authority approval. EUR continues to collaborate with a research group from University

Get Started

Atlas Lithium Provides Third Quarter 2023 Corporate

Aug 22, 2024 · Progressing on Preliminary Economic Analysis Report for Release in Q1, 2024 Alongside Mineral Resource Estimate Boca Raton, Florida--(Newsfile Corp. - October 23,

Get Started

Tetra Reports 3Q:23 Results, Updates on Lithium Brine Unit

Oct 30, 2023 · Net income before taxes for the quarter was $8.5mn (10.8% of revenue) and compares to $6.5mn (9% of revenue) in the third quarter of 2022 and to $8.0mn (10.4% of

Get Started

Net profit of 35 lithium battery industry companies

Oct 28, 2021 · According to wind data, as of the closing on October 27, 43 of the 79 lithium battery companies disclosed the third quarter performance report, accounting for 54%. Among them,

Get Started

Atlas Lithium Provides Third Quarter 2022 Corporate

Aug 22, 2024 · Company''s Mineral Rights for Lithium Span 72,344 Acres, the Largest Exploration Footprint in Brazil Belo Horizonte, Brazil--(Newsfile Corp. - November 2, 2022) - Atlas Lithium

Get Started

TROPICAL-Q3-FS-2024-Draft06

Aug 8, 2024 · Dear Shareholders, We are delighted to present the financial highlights and key strategic developments for Tropical Battery Company Ltd. (Group) for the third quarter and the

Get Started

Li Auto to report Q3 2024 earnings on Oct 31

Oct 21, 2024 · Li Auto (NASDAQ: LI) will report unaudited financial results for the third quarter of 2024 before the US markets open on Thursday, October 31, it

Get Started

QuantumScape releases third-party test results of solid-state lithium

Apr 23, 2025 · According to foreign media reports, QuantumScape, a developer of solid-state lithium metal batteries for next-generation electric vehicles, has released an independent third

Get Started

Third-Party Test Results | QuantumScape

QuantumScape announced the release of an independent third-party laboratory testing report on the performance of its solid-state lithium-metal battery cells.

Get Started

Lithium Australia Quarterly Report June 2023

Jul 30, 2023 · STRONG GROWTH IN BATTERY RECYCLING VOLUMES During the quarter, a total of 319 tonnes of mixed batteries was collected for recycling, with a record total of 1,347

Get Started

QUARTERLY REPORT

Apr 5, 2023 · On 9 March 2023, the Company issued 40,000,000 ordinary shares upon the conversion of performance rights. The ASX Appendix 5B quarterly report is attached to and

Get Started

Ganfeng Lithium Group Co., Ltd. 2023 Sustainability Report

Jun 6, 2024 · About This Report This is the eighth Sustainability Report (or Social Responsibility Report) by Ganfeng Lithium Group Co., Ltd., which aims to respond to stakeholders''

Get Started

Cai said an article to understand the current situation of the

Nov 7, 2023 · The curtain on the performance of the third quarter report has come to an end, and the "report card" handed over by the new energy power battery industry chain, which has

Get Started

Li-Cycle Set to Report Q3 2024 Earnings Amid Strong Market Performance,

Dec 5, 2024 · Li-Cycle s Q3 2024 Earnings Announcement Poised to Capture Investor Interest Li-Cycle Holdings Corp (NYSE: LICY), recognized as a global leader in lithium-ion battery

Get Started

Lithium Metal Prices, News, Index, Chart and

In Q2 2025, the lithium metal prices in the United States reached 1,47,930 USD/MT in June. Lithium metal surged in June on EV optimism, salts market

Get Started

CATL Reports Strong Q3 Profit Growth, Driven by Higher

Oct 22, 2024 · Amid the current lithium battery cycle, CATL (Contemporary Amperex Technology Co., Ltd.) continues to achieve counter-cyclical growth, with its profitability steadily increasing.

Get Started

6 FAQs about [Lithium battery group third quarter performance report]

How many batteries did CATL ship in Q3 2024?

In Q3 2024, CATL shipped over 120 GWh of batteries, a quarter-on-quarter increase of about 15%, with less than one-fourth of this being energy storage batteries and three-fourths being EV batteries.

What is CATL's EV battery market share?

Domestically, CATL's EV battery market share reached 45.9% in the first nine months of 2024, a year-on-year increase of 3.1 percentage points, maintaining its top rank. On the energy storage side, CATL saw a substantial increase in overseas shipments.

How has CATL performed in Q3 2024?

Despite this, CATL has maintained quarterly net profits above RMB 10 billion due to continued improvements in its gross profit margin. In Q3 2024, CATL's gross profit margin reached 31.17%, the highest since Q4 2018.

Why did CATL's profit margin increase in Q3 2024?

In Q3 2024, CATL's gross profit margin reached 31.17%, the highest since Q4 2018. At CATL's Q3 earnings briefing, CFO Zeng Shu explained that the gross margin increase was driven by further declines in the prices of key materials, such as lithium carbonate, alongside reduced sales prices.

Which battery brands are coming out in 2022 & 2023?

These battery brands were launched in 2022 and 2023, respectively. This year, CATL has introduced multiple new products, including the Shenxing Plus Battery, the next-generation high-power Kirin Battery, and the Tianheng Energy Storage System.

What EV batteries will CATL sell next year?

These two products are expected to account for 30% to 40% of CATL's EV battery shipments this year and could rise to 70% to 80% next year. The Kirin Battery is targeted at the high-end passenger car market, while the Shenxing Battery focuses on the value-for-money passenger car segment.

Related Articles

-

Prague energy storage lithium battery cost performance

Prague energy storage lithium battery cost performance

-

Azerbaijan energy storage lithium battery cost performance

Azerbaijan energy storage lithium battery cost performance

-

Modern lithium battery group in Lagos Nigeria

Modern lithium battery group in Lagos Nigeria

-

Kathmandu Energy Storage System Lithium Battery

Kathmandu Energy Storage System Lithium Battery

-

Polish container photovoltaic energy storage lithium battery brand

Polish container photovoltaic energy storage lithium battery brand

-

Communication base station lithium battery installation

Communication base station lithium battery installation

-

Huawei Energy Storage Lithium Battery System

Huawei Energy Storage Lithium Battery System

-

What is the function of cylindrical lithium battery

What is the function of cylindrical lithium battery

-

Beijing lithium battery bms development

Beijing lithium battery bms development

-

Rabat good lithium battery pack factory price

Rabat good lithium battery pack factory price

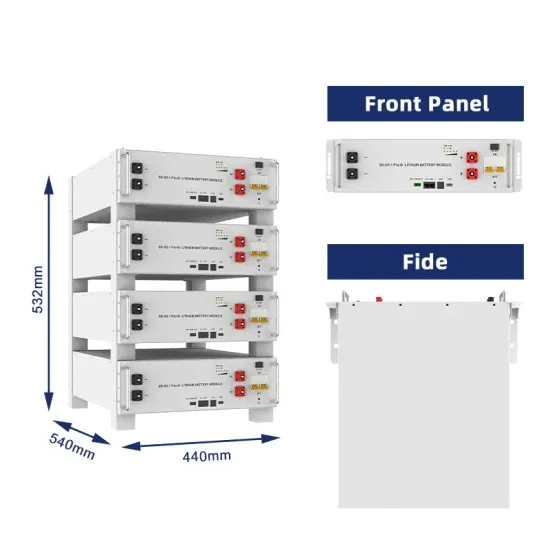

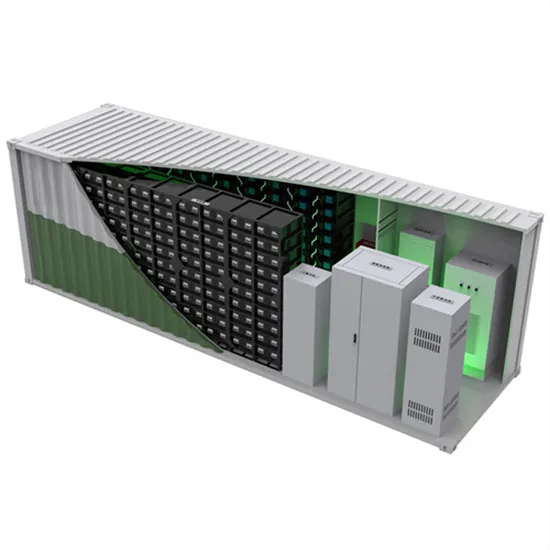

Commercial & Industrial Solar Storage Market Growth

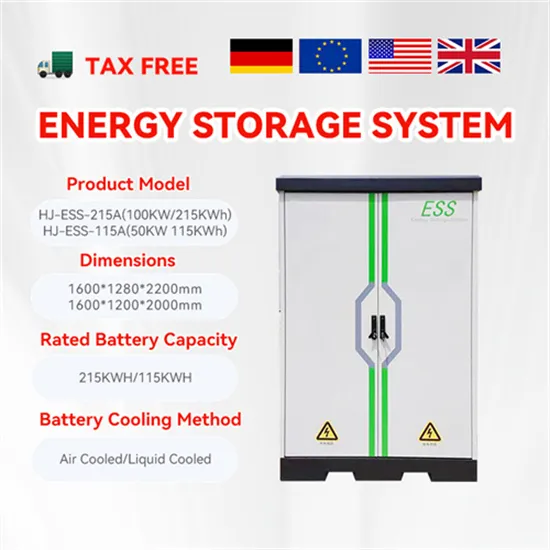

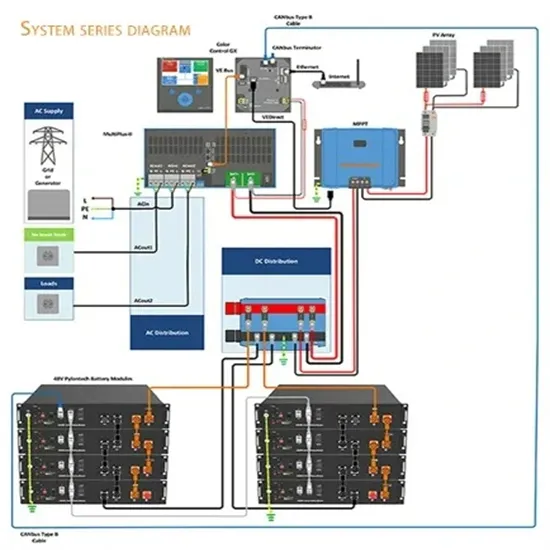

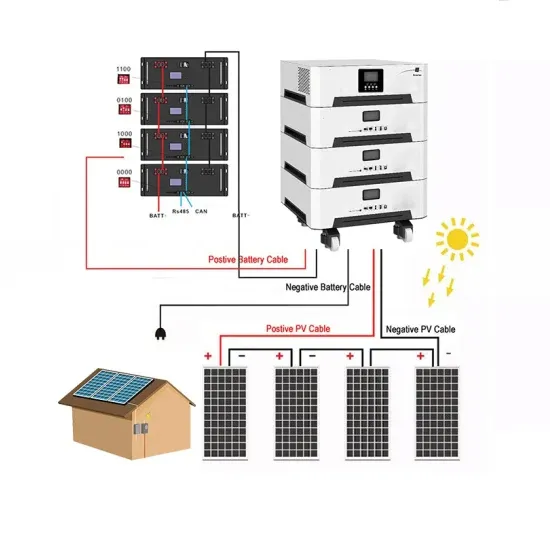

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.