Solar Levelized Cost of Energy Analysis

Apr 3, 2025 · Watch these video tutorials to learn how NREL analyzes PV projects with regards to LCOE, internal rate of return, and levelized cost of

Get Started

GB BESS Outlook Q3 2024: Battery business case and

We estimate that battery revenues must increase further to ensure an investable rate of return on the upfront Capex investment required - equivalent to around £600k/MW for a two-hour

Get Started

Current and Future Costs of Renewable Energy Project

Jul 24, 2020 · Energy Information Administration Federal Reserve Economic Data gigawatt investor-owned utility independent power producer internal rate of return investment tax credit

Get Started

Energy Storage System Investment Decision Based on Internal Rate of Return

Jul 6, 2023 · IRR measures the return on investment for energy storage projects and represents the average annual rate of return, resulting in a net present

Get Started

Achieving Acceptable Internal Rate of Return for

Jun 8, 2022 · Jason Schwartzberg, President, MD Energy Advisors The real estate development industry has been negatively impacted by a continued

Get Started

Best Practices Guide: Economic & Financial Evaluation of

Aug 26, 2020 · Asia Least Cost Greenhouse Gas Abatement Project Asia Alternative Energy Unit (the World Bank) Benefit-Cost Ratio British Thermal Unit per pound Cost Benefit Analysis

Get Started

Financing Energy Storage: A Cheat Sheet

Sep 21, 2018 · 10-20% — Target Internal Rate of Return (IRR) for equity investors in energy storage projects (based on conversations with developers, vendors,

Get Started

Understanding the Return of Investment (ROI) of Energy Storage

2 days ago · Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to

Get Started

INDEPENDENT ENERGY STORAGE CAPITAL RETURN RATE

INDEPENDENT ENERGY STORAGE CAPITAL RETURN RATE Key words: independent, new energy storage, price mechanism, cost grooming : TM 62,, . [J]., 2022, 11(12): 4067 ??? To

Get Started

Impact of cost, returns and investments: Towards renewable energy

Dec 1, 2021 · The opportunities that manifests from investing in renewable energy, have recently come to be considered critical and substantive worldwide. When compared to fossil fuels

Get Started

The impact of changing energy prices, interest rates, and

Mar 12, 2025 · This study investigates how changes in energy prices, interest rates, and investment costs impact the Net Present Value (NPV) and Internal Rate of Return (IRR) of

Get Started

The internal rate of return (IRR) of BECCS plants

The internal rate of return (IRR) of BECCS plants as a function of power plant load factor and efficiency is shown here at a constant electricity price of £80

Get Started

Annual return on energy storage investment

nt decision process are as follows: 1. This paper proposes an investment decision-making method based on the investment internal rate of return to calculate annual cash inflow and

Get Started

The facts on internal rate of return & sell-downs

May 17, 2023 · We look at what happens to the internal rate of return in investment projects in which a significant ownership stake is sold to a third party.

Get Started

Solar Farm Economics: Analyzing ROI & IRR

May 16, 2025 · Solar Farm Economics: Internal Rate Of Return Solar farms typically deliver IRRs in the range of 5% to 8%, depending on installation

Get Started

Evaluating energy storage tech revenue

Feb 11, 2025 · The revenue potential of energy storage technologies is often undervalued. Investors could adjust their evaluation approach to get a true

Get Started

FINANCIAL AND ECONOMIC ANALYSIS

Feb 4, 2023 · Cost streams used to determine the financial internal rate of return (FIRR) and economic internal rate of return (EIRR)—capital investment and operation and

Get Started

The importance of internal rate of return (IRR) in

Mar 14, 2024 · IRR helps companies rank and select capital projects to pursue based on profitability. Investors also use IRR to evaluate returns on different

Get Started

Estimation of Internal Rate of Return for Battery

Aug 12, 2022 · This paper assesses the profitability of battery storage systems (BSS) by focusing on the internal rate of return (IRR) as a profitability measure

Get Started

Methods for Financial Assessment of Renewable

Jan 18, 2022 · The methods for evaluating RES projects were grouped into four categories: (i) traditional metrics based on net present value, internal rate of

Get Started

Why Renewable Energy Projects Have Different

Jun 7, 2022 · When delving into discussions surrounding renewable energy projects, the inevitable question of returns often takes center stage. Investors

Get Started

NPV, IRR and Payback Period Calculator for Solar

Jun 20, 2025 · Quickly calculate NPV, IRR, and payback for solar commercial projects with easy tools designed for smarter business decisions.

Get Started

481237_1_En_12_Chapter 149.

Aug 8, 2019 · uses particle swarm optimization algorithm based on hybridization and Gaussian mutation to get the energy storage capacity that maximizes the internal rate of return of the

Get Started

Understanding KPIs for Renewable Energy Projects

Nov 16, 2023 · In the renewable energy sector, evaluating project viability and performance hinges on understanding Key Performance Indicators - KPIs for

Get Started

Financial Investment Valuation Models for

May 30, 2024 · Energy production through non-conventional renewable sources allows progress towards meeting the Sustainable Development Objectives

Get Started

9.4: Project Decision Metrics: Internal Rate of Return

The (IRR) can also be compared to the investor''s "hurdle rate," which is the lowest return that an investor is willing to accept before putting money into a project. Energy projects that will sell

Get Started

An introduction to the Internal Rate of Return

May 19, 2021 · Excel has a built-in function called IRR, and the configuration is incredibly simple. The formula is just equals IRR, and then open parenthesis,

Get Started

481237_1_En_12_Chapter 149.

Aug 8, 2019 · Energy Storage System Investment Decision Based on Internal Rate of Return Jincheng Wu, Shufeng Dong, Chengsi Xu, Ronglei Liu, Wenbo Wang and Yuanyun Dong

Get Started

What does energy storage IRR mean? | NenPower

Jan 27, 2024 · The Internal Rate of Return (IRR) in energy storage quantifies the financial viability of investing in energy storage systems. It is defined as the compounding annual return rate

Get Started

Commercial Solar ROI: Calculate Your

5 days ago · Many California agricultural, commercial & industrial businesses have reaped the financial benefit of installing commercial solar panels (solar

Get Started

Economic and financial appraisal of novel large-scale energy storage

Jan 1, 2021 · Energy storage can store surplus electricity generation and provide power system flexibility. A Generation Integrated Energy Storage system (GIES) is a class of energy storage

Get Started

Evaluating Battery Energy Storage Projects Financial and

Feb 19, 2025 · Evaluating Battery Energy Storage Projects Financial and Performance Outcomes Peter Belmonte | Business Development Director Key financial metrics for evaluating BESS

Get Started

6 FAQs about [Internal rate of return for energy storage projects]

Is the internal rate of return a profitability measure for battery storage systems?

Multiple requests from the same IP address are counted as one view. This paper assesses the profitability of battery storage systems (BSS) by focusing on the internal rate of return (IRR) as a profitability measure which offers advantages over other frequently used measures, most notably the net present value (NPV).

Does internal rate of return matter in battery storage systems?

Author to whom correspondence should be addressed. This paper assesses the profitability of battery storage systems (BSS) by focusing on the internal rate of return (IRR) as a profitability measure which offers advantages over other frequently used measures, most notably the net present value (NPV).

How to calculate IRR of energy storage project?

A higher IRR indicates a shorter payback period. . To calculate the IRR of an energy storage project, we could follow below steps: 2-Calculate the annual net cash flow during the project's operation period by considering the difference between cash flow inflow and outflow;

What is internal rate of return (IRR)?

Internal Rate of Return (IRR) This paper is based on the IRR as a key economic metric for assessing the profitability of investment projects.

Should internal rate of return (IRR) be used to assess profitability?

We argue in favour of the internal rate of return (IRR) as a preferred method to assess profitability given the advantages over the popular net present value (NPV) and many other frequently used profitability measures.

What are the three key indicators of a storage project?

To assess the feasibility, profitability, and payback period of such projects, three key indicators are commonly used: Levelized Cost of Storage ( #LCOS ), Internal Rate of Return ( #IRR ), and Net Present Value ( #NPV ). .

Related Articles

-

Return rate of energy storage power station

Return rate of energy storage power station

-

Energy storage projects and quotations

Energy storage projects and quotations

-

The impact of energy storage projects on the surrounding areas

The impact of energy storage projects on the surrounding areas

-

Designed land for energy storage projects

Designed land for energy storage projects

-

Energy storage projects can increase carbon assets

Energy storage projects can increase carbon assets

-

Suggestions for promoting energy storage projects

Suggestions for promoting energy storage projects

-

Colombia is suitable for energy storage projects

Colombia is suitable for energy storage projects

-

10 energy storage for photovoltaic projects

10 energy storage for photovoltaic projects

-

Classification of communication base station battery energy storage system projects

Classification of communication base station battery energy storage system projects

-

Latest Energy Storage System Projects

Latest Energy Storage System Projects

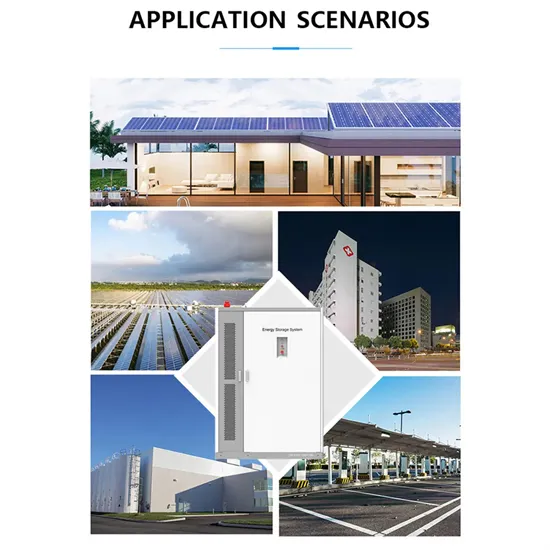

Commercial & Industrial Solar Storage Market Growth

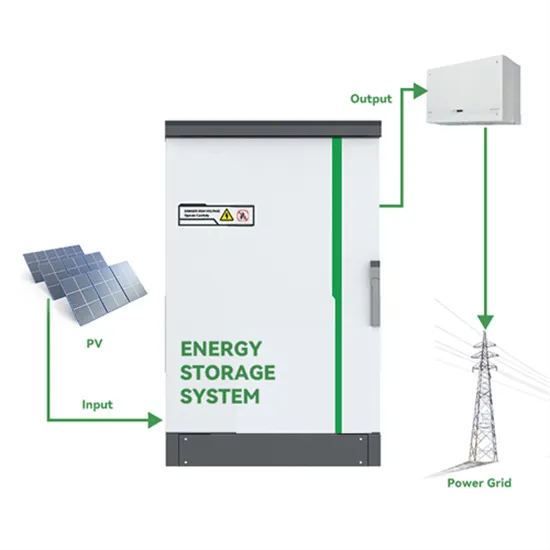

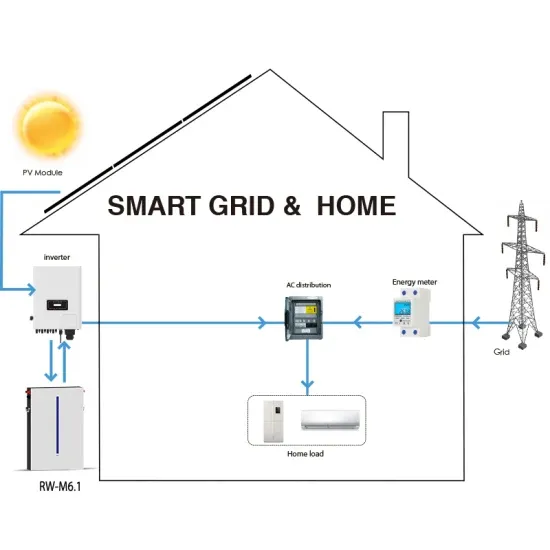

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

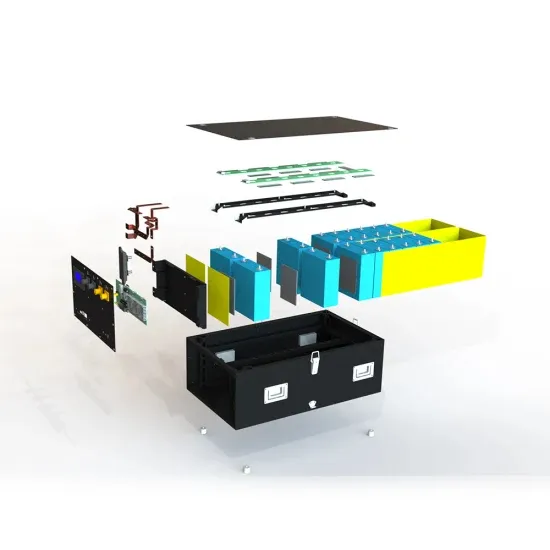

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.