Understanding the Return of Investment (ROI) of Energy Storage

5 days ago · Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to

Get Started

Pumped storage power stations in China: The past, the

May 1, 2017 · The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Get Started

How much does a large energy storage power station cost?

Sep 5, 2024 · Cost of a large energy storage power station varies considerably based on multiple factors, including 1. technology employed, 2. geographical location, 3. capacity and 4. design

Get Started

Investment cost of industrial and commercial energy

In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three aspects of

Get Started

How much is the profit of energy storage power station

Jan 17, 2024 · The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging

Get Started

How much investment can be recovered from energy storage power stations

Aug 24, 2024 · 1. The returns on investment from energy storage power stations vary, mainly influenced by factors such as initial outlay, operational efficiency, and market dy

Get Started

How much does energy storage power station design cost?

Jun 20, 2024 · Determining the cost associated with the design of an energy storage power station involves various factors, including technical specifications, location, size, and

Get Started

Flexible Power and Energy Systems for the

May 31, 2024 · Exploring modular power supply and energy solutions for industrial drives to reduce peak power, promote efficiency and reduce

Get Started

The Peak-Shaving Role of Energy Storage

Jan 9, 2019 · This article provided by GeePower delves into the importance of energy storage stations in peak-shaving within power systems. It also details

Get Started

What is the valuation of energy storage power station

Jul 26, 2024 · The valuation of energy storage power station acquisition involves several critical factors that collectively dictate the financial assessment and potential investment returns of

Get Started

Return on Investment (ROI) of Energy Storage Systems:

Mar 1, 2025 · Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

Get Started

How do factory energy storage investors make money?

May 10, 2024 · Factory energy storage investors generate income through 1. Energy arbitrage opportunities, 2. Ancillary services, 3. Demand charge reduction, 4. Long-term contracts or

Get Started

Three business models for industrial and

Aug 16, 2025 · In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management

Get Started

Economic Analysis and Research on Investment Return of Energy Storage

Aug 22, 2021 · Economic Analysis and Research on Investment Return of Energy Storage Participating in Thermal Power Peak and Frequency Modulation Published in: 2021 Power

Get Started

Technology, cost, economic performance of distributed photovoltaic

Aug 1, 2019 · The operation and maintenance costs of distributed PV mainly include depreciation of power stations, labor costs, spare equipment costs, equipment maintenance costs, etc.

Get Started

return on investment of energy storage power station

On February 24, the 100MW/200MW energy storage station of Ningdong Photovoltaic Base under Ningxia Power Co., Ltd. ("Ningxia Power" for short), a subsidiary of CHN Energy, was

Get Started

Financial Analysis Of Energy Storage

6 days ago · The return of investment is an important metric about how attractive an investment may be. However this is an important note that energy storage usually does not generate

Get Started

Capacity investment decisions of energy storage power stations

Sep 12, 2023 · To this end, this paper constructs a decision-making model for the capacity investment of energy storage power stations under time-of-use pricing, which is intended to

Get Started

How much investment can be recovered from energy storage power stations

Aug 24, 2024 · 1. The returns on investment from energy storage power stations vary, mainly influenced by factors such as initial outlay, operational efficiency, and market dynamics.2.

Get Started

What is the annual income of energy storage

Apr 3, 2024 · Energy storage power stations derive income through multiple avenues, which include demand response, frequency regulation, and energy

Get Started

How is the factory energy storage power station business?

Mar 23, 2024 · The energy storage power station sector is poised for transformative growth, influenced by the urgent demand for renewable energy integration, technological

Get Started

How much does the factory energy storage

Aug 17, 2024 · The price of factory energy storage power supplies varies significantly based on several factors, including 1. Type of storage technology,

Get Started

Return on investment for energy storage stations

Are battery energy storage systems a good investment? Energy storage systems (ESSs) are being deployed widely due to numerous benefits including operational flexibility, high ramping

Get Started

How is the profit of enterprise energy storage power station?

Apr 7, 2024 · A pivotal element influencing the financial viability of energy storage power stations is their operational efficiency. The efficiency rates dictate how much of the power stored can

Get Started

How much is the actual profit of energy storage power station?

Feb 12, 2024 · 1. Energy storage power stations generate profits through diverse revenue streams, including ancillary services and capacity payments. 2. Their profitability is also

Get Started

How much does a factory energy storage power station cost?

Feb 7, 2024 · The cost of a factory energy storage power station varies widely depending on several factors, including 1. technology type, 2. scale and capacity, 3. installation and

Get Started

Flexible energy storage power station with dual functions of power

Nov 1, 2022 · The high proportion of renewable energy access and randomness of load side has resulted in several operational challenges for conventional power systems. Firstly, this paper

Get Started

What is the output value of energy storage

Jan 26, 2024 · The output value of energy storage power stations is determined by several critical factors that influence their efficiency and economic viability.

Get Started

How is the investment profit of energy storage power station?

Oct 2, 2024 · The Return on Investment (ROI) for energy storage power stations is influenced by multiple elements including initial investment costs, technology efficiency, operational

Get Started

Is battery storage a good investment opportunity?

Nov 22, 2024 · But does this make batteries investable? Understanding the Return on Investment (ROI) potential of storage is an exceptionally dificult task. There are many levers which afect a

Get Started

How is the price of energy storage power station calculated?

Apr 22, 2024 · A pivotal aspect influencing the overall price structure of energy storage power stations is initial capital outlay. This investment encompasses various critical components,

Get Started

A study on the energy storage scenarios design and the

Sep 1, 2023 · Energy storage is an important link for the grid to efficiently accept new energy, which can significantly improve the consumption of new energy electricity such as wind and

Get Started

6 FAQs about [Return on investment of factory energy storage power station]

What factors influence the ROI of a battery energy storage system?

Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control.

How do I assess the ROI of a battery energy storage system?

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control. External Factors that influence the ROI of a BESS

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

Does energy storage configuration maximize total profits?

On this basis, an optimal energy storage configuration model that maximizes total profits was established, and financial evaluation methods were used to analyze the corresponding business models.

How can energy storage benefits be improved?

By adjusting peak and valley electricity prices and opening the FM market, energy storage benefits can be greatly improved, which is conducive to promoting the development of zero-carbon big data industrial parks, and technical advances are beneficial for reducing investment costs.

Related Articles

-

Investment Unit of Air Energy Storage Power Station

Investment Unit of Air Energy Storage Power Station

-

How much is the minimum investment for an energy storage power station

How much is the minimum investment for an energy storage power station

-

Hungary Pecs Energy Storage Power Station Investment

Hungary Pecs Energy Storage Power Station Investment

-

Total investment of Lobamba photovoltaic energy storage power station

Total investment of Lobamba photovoltaic energy storage power station

-

Lithium battery energy storage power station investment

Lithium battery energy storage power station investment

-

Australian energy storage power station investment

Australian energy storage power station investment

-

Nanya Sodium Battery Energy Storage Power Station

Nanya Sodium Battery Energy Storage Power Station

-

Gitega Centralized Energy Storage Power Station

Gitega Centralized Energy Storage Power Station

-

Base station external power supply energy storage

Base station external power supply energy storage

-

Vaduz Photovoltaic Energy Storage Power Station

Vaduz Photovoltaic Energy Storage Power Station

Commercial & Industrial Solar Storage Market Growth

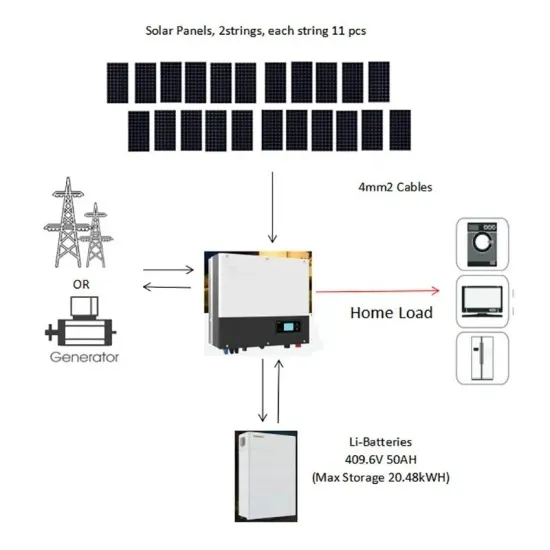

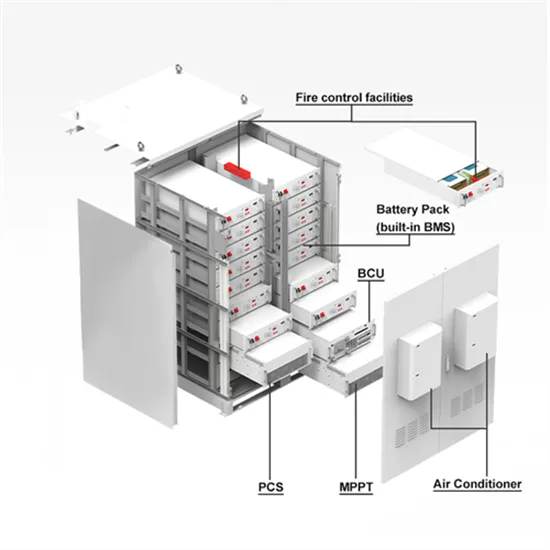

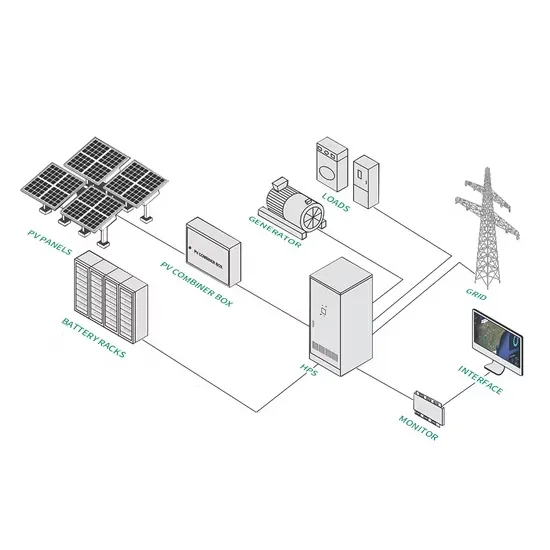

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

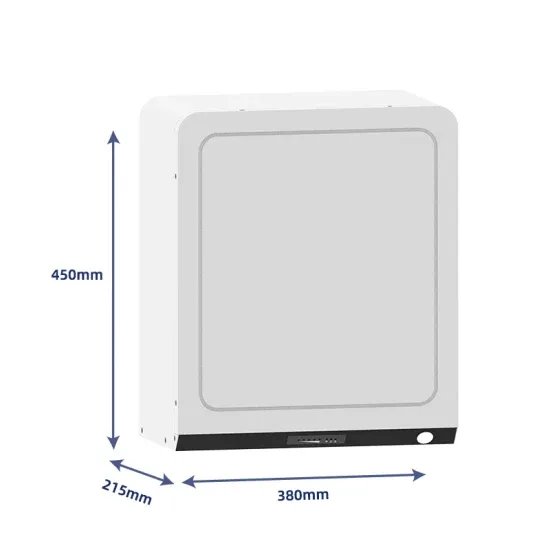

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.