Economic evaluation of grid-connected micro-grid system

Dec 15, 2016 · Meanwhile for the financing problems of micro-grid system with small and medium PV system, the user-self-investment model, third-party financing model and joint venture

Get Started

Battery energy storage system modeling: A combined

Feb 1, 2019 · Battery pack modeling is essential to improve the understanding of large battery energy storage systems, whether for transportation or grid storage. I

Get Started

Profitability, risk, and financial modeling of energy storage in

Jan 15, 2017 · Revenues from energy arbitrage were identified using the proposed models to get a better view on the profitability of the storage system. Moreover, the feasibility of energy

Get Started

Making project finance work for battery energy storage

Why securing project finance for energy storage projects is challenging It has traditionally been difficult to secure project finance for energy storage for two key reasons. Firstly, the nascent

Get Started

Structuring a bankable project: energy storage

Jun 15, 2022 · This note explains the principal technologies used for energy storage solutions, with a particular focus on battery storage, and the role that energy storage plays in the

Get Started

127135|123800

Aug 19, 2025 · There are many potential pathways for financing renewable energy generation, storage, and energy eficiency projects. While not intended to be prescriptive, the above 6-step

Get Started

Financing Smart Grid and Energy Storage Projects

Feb 4, 2025 · Energy storage systems (ESS) and smart grid technologies are at the core of this transition, enabling greater flexibility, reliability, and

Get Started

The Art of Financing Battery Energy Storage

Oct 11, 2023 · Author: Elgar Middleton The Art of Financing Battery Energy Storage Systems (BESS) Elgar Middleton has extensive debt and equity

Get Started

ENERGY STORAGE PROJECTS

2 days ago · LPO can help reduce these barriers by financing early deployments of energy storage technologies and associated supply chains, proving to

Get Started

Navigating energy storage financing amidst rising interest

Jul 14, 2025 · Developers, investors, and policymakers now have a unique opportunity to redefine how storage projects are financed, deployed, and monetized. From revenue stacking

Get Started

Financing Energy Storage: A Cheat Sheet

Sep 21, 2018 · As such, we''re providing this "Cheat Sheet for Energy Storage Finance" based on our work as buy-side and sell-side investment bankers

Get Started

Financing Battery Storage Systems: Options and

Aug 15, 2023 · Recently, Peak Power conducted an energy storage finance webinar that focused on strategies available for financing battery storage

Get Started

Top 5 Energy Storage Financing Models | HuiJue Group E-Site

The global energy transition requires 387 GW of new storage capacity by 2030, but traditional financing models keep tripping over three core challenges: unpredictable revenue streams,

Get Started

How to finance battery energy storage | World

May 10, 2024 · Battery energy storage systems can address the challenge of intermittent renewable energy. But innovative financial models are needed to

Get Started

Project Financing and Energy Storage: Risks and

Mar 8, 2023 · The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Get Started

Energy Storage Financing for Social Equity

Jul 22, 2022 · Abstract Energy storage technologies are uniquely qualified to help energy projects with a social equity component achieve better financing options while providing the needed

Get Started

Enabling renewable energy with battery energy

Aug 2, 2023 · These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get Started

Innovative Financing Models for Home Energy Storage Systems

Oct 9, 2024 · 1. Innovative financing models for home energy storage systems encourage consumer adoption and help mitigate upfront costs, enhancing affordability through creative

Get Started

Energy Storage Financial Model

Fractal provides robust energy storage financial models to utilities, energy companies and investors. Fractal has spent years developing and optimizing

Get Started

Unlocking Energy Storage Financing Channels: A Roadmap

Sep 27, 2023 · 1. Project Financing (The Classic Hustle) Think of this as the mortgage of the energy world. Banks like Goldman Sachs and HSBC are now offering non-recourse loans

Get Started

Navigating energy storage financing amidst rising interest

Jul 14, 2025 · The path forward will require creativity, coordination, and continued investment—but the rewards are clear: a more resilient, reliable, and decarbonized grid.

Get Started

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get Started

Energy Storage Valuation: A Review of Use Cases and

Jun 24, 2022 · Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any

Get Started

What innovative financing models are available

Dec 31, 2024 · Innovative financing models for solar energy systems have expanded access to renewable energy, offering various options for different

Get Started

What are the energy storage project models? | NenPower

Oct 2, 2024 · These models focus on the decentralization of energy production and storage, allowing small-scale systems to benefit from shared resources. Community storage can

Get Started

BUSINESS MODELS AND FINANCING INSTRUMENTS IN

Jan 2, 2024 · 42 unique business models, categorized into 11 overarching themes, are shaping the trajectory of solar energy business and financing. As we dissect these models and

Get Started

A review of energy storage financing—Learning from and partnering with

Oct 1, 2018 · The energy storage industry has made great progress in developing technology, standards, and market policies and is poised to offer solutions to rapidly changing energy

Get Started

Working Group 3

WG3 highlights the challenges in remuneration of storage services and in financing innovative solutions, while also assessing how to leverage energy storage to ensure energy security,

Get Started

Handbook on Battery Energy Storage System

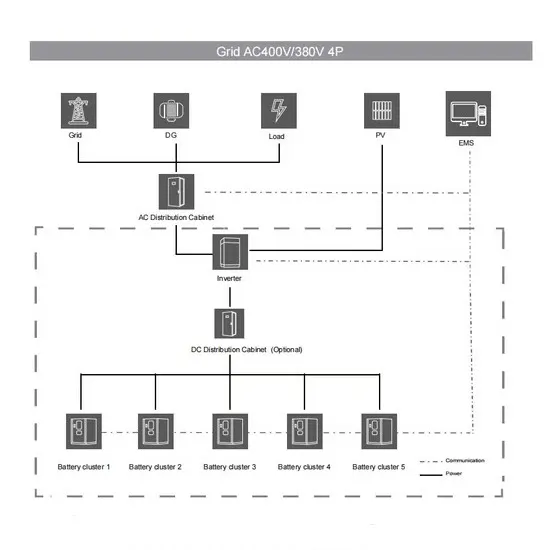

Aug 13, 2020 · One energy storage technology in particular, the battery energy storage system (BESS), is studied in greater detail together with the various components required for grid

Get Started

Energy Storage Financing: Advancing Contracting in

Apr 15, 2022 · Energy Storage Financing The Energy Storage Financing study series is an outreach effort to the financial industry to help reduce and mitigate the risk of investing in

Get Started

What is the concept of energy storage

Jan 19, 2024 · Energy storage financing refers to the methods and mechanisms applied to fund energy storage systems effectively. 1. It encompasses

Get Started

Battery Energy Storage Solutions for Businesses

1 day ago · Driven by these changing trends, battery energy storage is becoming a key technology to support the energy transition. Enel X Global Retail is

Get Started

Battery Energy Storage Financing Structures and

4 days ago · Financing structure options for standalone storage projects and hybrid solar plus storage projects. The pool of potential investors in these projects by allowing project owners to

Get Started

Exploring Battery Energy Storage Systems:

6 days ago · Battery Energy Storage Systems are essential for the future of renewable energy, providing efficient solutions for storing and managing

Get Started

Financing the Energy Transition – Funding battery storage

Jun 7, 2023 · The UK Government has recognised the crucial importance of renewables in generating electricity in its Energy Security Plan, and has announced a raft of measures aimed

Get Started

4 FAQs about [Small Energy Storage System Financing Model]

What is a battery energy storage system?

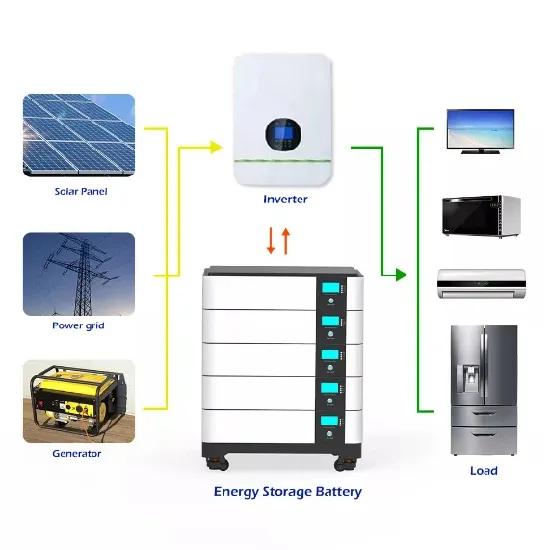

Battery energy storage system. Battery energy storage systems (BESS) can help address the challenge of intermittent renewable energy. Large scale deployment of this technology is hampered by perceived financial risks and lack of secured financial models.

What is battery energy storage system (BESS)?

Battery energy storage systems (BESS) are accepted as one of the key solutions to address these challenges. BESS can respond to real-time renewable energy fluctuation challenges through its fast response capability (congestion relief, frequency regulation, wholesale arbitrage, etc.).

How is debt financing structured?

Debt financing can be structured in such a way that BESS is optimally used. For example, the outcome can be a number of charge/discharge cycles, the ability to respond to supply/demand with very low breakdown times, the cost of supplying electricity, the ability to recycle after-life BESS systems, etc.

What is a battery-as-a-service (BaaS) business model?

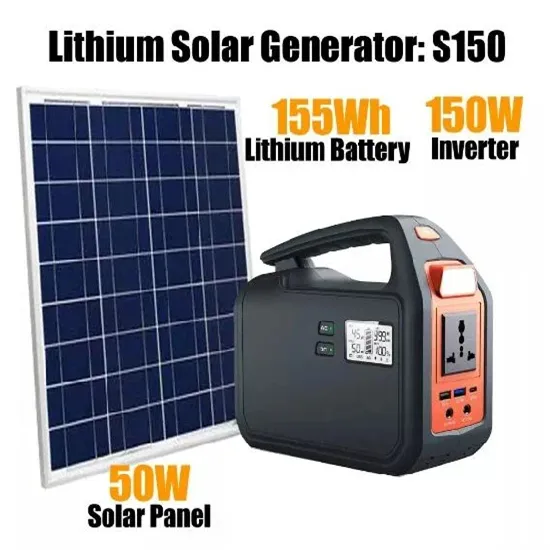

New-age business models such as battery-as-a-service (BaaS) allows the user to avoid high-upfront costs and technology performance risks. BaaS includes Customized Leasing Models (CLM) where the lessor bears the upfront capital.

Related Articles

-

Large-scale independent energy storage financing model

Large-scale independent energy storage financing model

-

How many watts does a small energy storage power station have

How many watts does a small energy storage power station have

-

Apia grid-side energy storage cabinet model

Apia grid-side energy storage cabinet model

-

Small energy storage power station voltage

Small energy storage power station voltage

-

Ranking of suppliers of small energy storage cabinets in Podgorica

Ranking of suppliers of small energy storage cabinets in Podgorica

-

How much is the price of the Czech small energy storage cabinet factory

How much is the price of the Czech small energy storage cabinet factory

-

1 kW small energy storage device

1 kW small energy storage device

-

Small solar energy storage cabinet production process

Small solar energy storage cabinet production process

-

What is the model of Iceland s heavy industry energy storage cabinet

What is the model of Iceland s heavy industry energy storage cabinet

-

Small Energy Storage Power Station Solutions

Small Energy Storage Power Station Solutions

Commercial & Industrial Solar Storage Market Growth

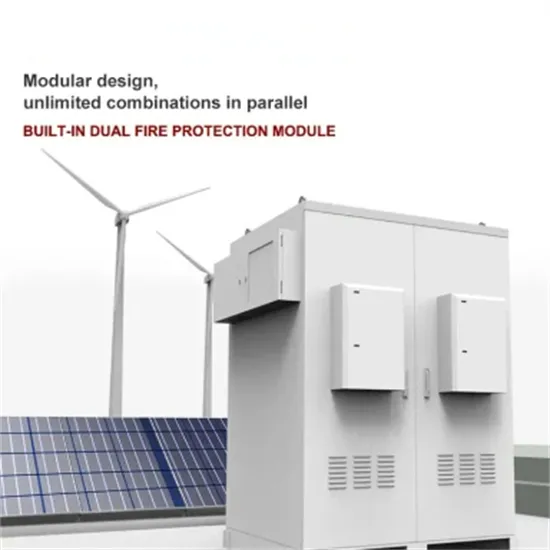

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.