Equatorial guinea jingye energy storage project

Chinese state-owned utility Beijing Jingneng has revealed that it will spend CNY23 billion (US$3 billion) on a 5GW hybrid solar, wind, hydrogen and storage facility in

Get Started

1 3 billion energy storage project

TRSDC secured financial close on its own debt facilities for the project,totalling US$3.76 billion,last month. Huawei will supply the battery energy storage system (BESS),as reported by

Get Started

Pipelines Critical to Equatorial Guinea''s

An estimated two-thirds of the reduced capital expenditure is to be channeled to the Alen gas monetization development project in Equatorial Guinea as Noble

Get Started

Energy Storage Batteries in Equatorial Guinea: Powering the

Why Equatorial Guinea Needs Energy Storage Solutions Now a country smaller than Maryland, sitting on Africa''s west coast, with enough oil reserves to make OPEC members smile. Yet

Get Started

Guinea Technology New Energy Storage Project Energy Storage

What is the biggest energy investment in Guinea? The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with

Get Started

PLANT ENERGY STORAGE GUINEA

Two towns in Guinea, a country in West Africa which grapples with issues of energy security, are reaping the benefits of newly installed solar PV (photovoltaic) mini-grids backed with battery

Get Started

Guinea s industrial and commercial subsidies for energy storage

Energy storage could save Germany €3 billion in subsidies by 2037 The nearly 50GW of battery storage that could be online by 2037 will increase the wholesale market revenues for wind and

Get Started

Guinea current energy storage technologies

Guinea''s hydropower potential is estimated at over 6,000MW,making it a potential exporter of powerto neighboring countries. The largest energy sector investment in Guinea is the 450MW

Get Started

Unlocking Opportunities: A K100 Million Investment in Fuel Storage

Dec 18, 2024 · Kumul Petroleum: A Bright Future Beyond Fuel Crises In a significant development for Papua New Guinea''s energy landscape, Kumul Petroleum Holdings Limited (KPHL) is

Get Started

Guinea energy storage america

While Ameresco''''s energy storage projects to date have been done using lithium-ion battery energy storage systems (BESS), including a 2.1GWh three-project portfolio underway for

Get Started

Chinese company builds new energy storage

Aug 18, 2025 · The energy storage power station built in Dengkou boasts photovoltaic power generating facilities with an annual capacity of generating

Get Started

New energy storage unit in Guinea

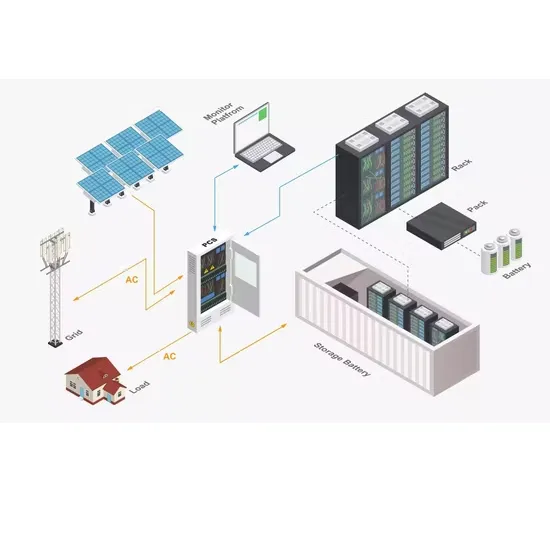

The Guinea Renewable Energy Storage System is a cutting-edge energy storage solution designed to enhance the reliability and efficiency of renewable energy integration.

Get Started

Guinea Energy Storage Power Generation

Guinea Energy Storage Power Generation Where can I find information on renewable power capacity & generation of Guinea? Find relevant data on Renewable Power Capacity and

Get Started

guinea off-grid energy storage

A consortium of developers has achieved financial close for US$1.3 billion in debt facilities for utilities infrastructure at the Red Sea project, a huge resort under construction off the coast of

Get Started

Papua New Guinea Grid Energy Storage Plan Public

The World Bank has approved a project by Papua New Guinea-based energy company PNG Power to support improvements to the company''''s operational and financial performance.

Get Started

WALNG Group To Supply Power to Guinea

Jul 24, 2024 · West Africa LNG (WALNG) Group''s Guinea LNG import project is expected to supply electricity to Guinea-Conakry by Q1 2025. The country''s

Get Started

Project Case: Guinea Renewable Energy Storage

Feb 6, 2023 · Sustainable and cost-effective: By integrating renewable energy with advanced battery storage technology, the project reduces reliance on

Get Started

GUINEA BISSAU ENERGY COUNTRY PROFILE

Guinea moss landing energy storage Utilities in California are required by a 2013 law to provide significant battery storage by 2024. On June 29, 2018,, which merged with Dynegy on April 9,

Get Started

China Exim provides funding for Guinea''s 450-MW Souapiti project

Mar 20, 2018 · The Export-Import Bank of China has approved a US$1.3 billion financing package for Guinea''s Souapiti hydropower plant, capping what the African country''s government calls

Get Started

Best way to store solar energy Equatorial Guinea

Energy Capital & Power, in partnership with the Ministry of Mines and Hydrocarbons, announced the launch of its Energy Invest: Equatorial Guinea 2021 report that serves as a critical tool to

Get Started

Papua new guinea energy storage project

The PNG Energy Utility Performance and Reliability Improvement Project (EUPRIP) comes at a crucial time for PNG, with Papua New Guineans across the country facing major challenges

Get Started

US Invests Nearly US$400 Million in Major Fuel Storage Project

Apr 29, 2025 · PORT MORESBY – In a significant boost to Papua New Guinea''s (PNG) infrastructure, the United States has awarded a contract valued at approximately US$400

Get Started

Guinea Energy Storage Power Generation

Is Guinea a potential exporter of power? Guinea''s hydropower potential is estimated at over 6,000MW,making it a potential exporter of powerto neighboring countries. The largest energy

Get Started

Guinea

Equatorial Guinea, a nation rich in oil and gas reserves, is now turning its attention to renewable energy integration. With global shifts toward sustainability, the country faces a critical question:

Get Started

''Energy storage guarantees energy security for

Mar 28, 2025 · A total of PLN 4.15 billion, or €992 million (US$1.07 billion), is available, split 90:10 between grants and loans. Grants can cover up to 45%

Get Started

Afreximbank emerges as financial advisor in Equatorial Guinea''s

Jul 31, 2025 · The African Export-Import Bank (Afreximbank) has been appointed as financial advisor for the $4.5 billion EG-27 liquified natural gas (LNG) project in Equatorial Guinea.

Get Started

GUINEA RENEWABLE ENERGY STORAGE SYSTEM SOLUTIONS

What type of energy is used in Guinea? Renewable energy here is the sum of hydropower, wind, solar, geothermal, modern biomass and wave and tidal energy. Traditional biomass – the

Get Started

papua new guinea energy storage market

The Papua New Guinea National Energy Access Transformation Project (NEAT or the ''''Project'''') will be financed by the World Bank and implemented by the National Energy Authority (NEA)

Get Started

Energy storage equatorial guinea business park

At 300MW / 1,200MWh, the world''''''''s largest battery storage system so far is up and running . At 300MW / 1,200MWh, the BESS is considerably larger than the 250MW / 250MWh Gateway

Get Started

China Power Construction New Energy Storage

New energy storage, or energy storage using new technologies such as lithium-ion batteries, liquid flow batteries, compressed air and mechanical energy, is an important foundation for

Get Started

How is the energy storage application field in Guinea

What is the biggest energy investment in Guinea? The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with

Get Started

Guinea energy storage pants

Guinea is set to construct the first liquefied natural gas (LNG) storage and regasification plant in West Africa, advancing efforts to monetize gas. Built by American manufacturer Corban

Get Started

6 FAQs about [Guinea s 3 billion energy storage project]

What is the biggest energy investment in Guinea?

The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with Chinese investment. A Chinese firm likewise completed the 240MW Kaleta Dam (valued at USD 526 million) in May 2015.

What is Guinea's energy strategy?

Includes a market overview and trade data. The Guinean government has announced a long-term energy strategy focusing on renewable sources of electricity including solar and hydroelectric as a way to promote environmentally friendly development, to reduce budget reliance on imported fuel, and to take advantage of Guinea’s abundant water resources.

Is Guinea a potential exporter of power?

Guinea’s hydropower potential is estimated at over 6,000MW, making it a potential exporter of power to neighboring countries. The largest energy sector investment in Guinea is the 450MW Souapiti dam project (valued at USD 2.1 billion), begun in late 2015 with Chinese investment.

Can China make guinea an energy exporter in West Africa?

The Chinese mining firm TBEA is providing financing for the Amaria power plant (300 MW, USD 1.2 billion investment). If corresponding distribution infrastructure is built, and pricing enables it, these projects could make Guinea an energy exporter in West Africa.

What will Guinea's energy mix look like by 2025?

Guinea’s energy mix by 2025 will be dominated by hydropower, which would account for over 80 percent of the total installed capacity, should these planned investments be realized. Solar power is also growing in popularity for both corporate and residential use.

How has Kaleta changed Guinea's electricity supply?

Kaleta more than doubled Guinea’s electricity supply, and for the first-time furnished Conakry with more reliable, albeit seasonal, electricity (May-November). Souapiti began producing electricity in 2021. A third hydroelectric dam on the same river, dubbed Amaria, began construction in January 2019 and is expected to be operational in 2024.

Related Articles

-

Peru energy storage investment 2 billion project

Peru energy storage investment 2 billion project

-

1 billion yuan energy storage project

1 billion yuan energy storage project

-

Vatican 30 6 billion energy storage project

Vatican 30 6 billion energy storage project

-

Papua New Guinea Economic Development Energy Storage Project

Papua New Guinea Economic Development Energy Storage Project

-

Energy Storage Industrial Park Project

Energy Storage Industrial Park Project

-

Windhoek Coal Mine Large Energy Storage Project

Windhoek Coal Mine Large Energy Storage Project

-

Warsaw user-side energy storage project

Warsaw user-side energy storage project

-

Bissau energy storage project equipment requirements

Bissau energy storage project equipment requirements

-

Russian hybrid energy storage project

Russian hybrid energy storage project

-

Cairo Northwest Liquid Flow Energy Storage Project

Cairo Northwest Liquid Flow Energy Storage Project

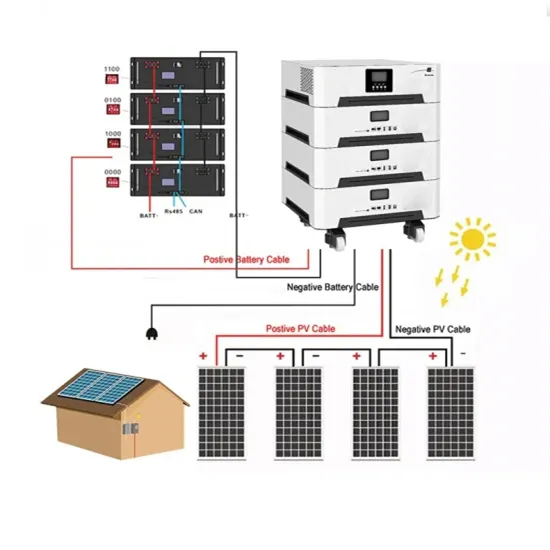

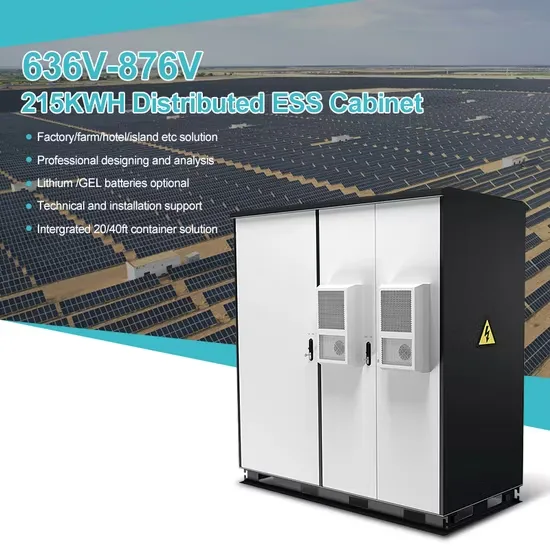

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

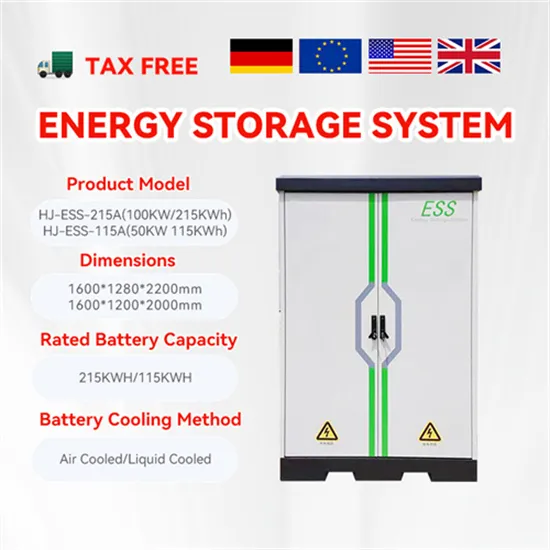

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.