How to create revenue with a BESS project

Dec 11, 2024 · Battery Energy Storage Systems (BESS) provide operators with multiple avenues to generate revenue. These systems are not limited to a

Get Started

Financial Analysis Of Energy Storage

6 days ago · It is a great tool to analyse the profitability of an investment independent of different lifetimes and account for inflation and degradation – two of the biggest impacts on profitability.

Get Started

Research on Cost and Economy of Pumped Storage Power Station

May 14, 2023 · With the increasing scale of new energy construction in China and the increasing demand of power system for regulating capacity, it is imperative to accelerate the large-scale

Get Started

Energy Storage Power Station Profit Analysis: Where

Oct 28, 2020 · Let''s face it – when most people hear "energy storage," they picture clunky car batteries or that forgotten power bank in their junk drawer. But energy storage power station

Get Started

Energy storage project profitability analysis

Energy storage project profitability analysis Abstract: The economic benefit of energy storage projects is one of the important factors restric. ed the application of energy storage systems.

Get Started

Analysis of energy storage power station investment and

Nov 9, 2020 · In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Get Started

Utility-scale battery energy storage system (BESS)

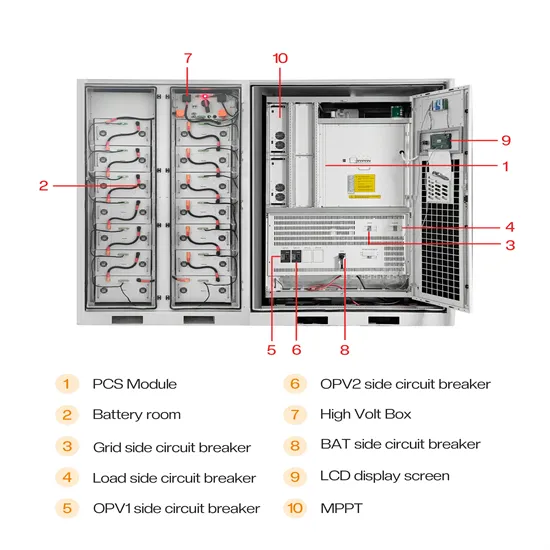

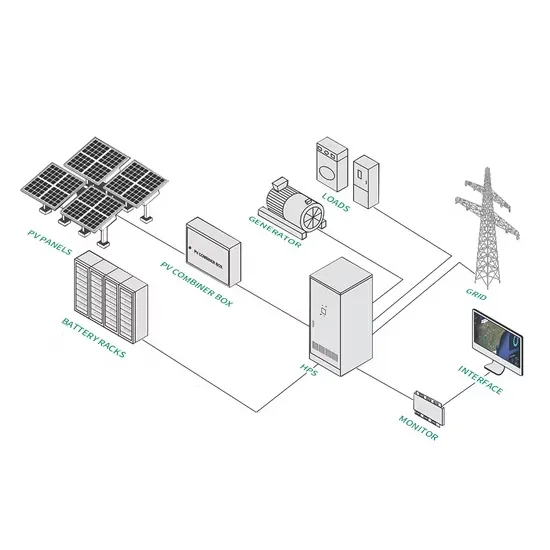

Mar 21, 2024 · Introduction Reference Architecture for utility-scale battery energy storage system (BESS) This documentation provides a Reference Architecture for power distribution and

Get Started

What is the energy storage power station

May 23, 2024 · The energy storage power station project entails a sophisticated system that integrates various components aimed at storing energy for future

Get Started

Can energy storage power stations be profitable

Battery storage power station – a comprehensive guide This article provides a comprehensive guide on battery storage power station (also known as energy storage power stations). These

Get Started

Profits from investing in energy storage power stations

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Get Started

Is Grid Energy Storage Profitable? Exploring the Economics

Feb 7, 2025 · Why Grid Energy Storage Is Suddenly Making Headlines (and Dollars) Let''s cut to the chase – grid energy storage isn''t just about saving the planet anymore. With companies

Get Started

Can energy storage power stations be profitable

How can energy storage be profitable? Where a profitable application of energy storage requires saving of costs or deferral of investments,direct mechanisms,such as subsidies and

Get Started

Evaluating energy storage tech revenue

Feb 11, 2025 · Owners of energy storage systems can tap into diversified power market products to capture revenues. So-called "revenue stacking" from

Get Started

How can individuals carry out energy storage power station projects

Feb 27, 2024 · The undertaking of energy storage power station projects entails a multifaceted approach grounded in meticulous planning and informed decision-making. Individuals aspiring

Get Started

China''s Largest Grid-Forming Energy Storage Station

Apr 9, 2024 · On March 31, the second phase of the 100 MW/200 MWh energy storage station, a supporting project of the Ningxia Power''s East NingxiaComposite Photovoltaic Base Project

Get Started

how profitable is the energy storage power station

Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Get Started

How many years does it take for an energy storage power station

Apr 5, 2024 · The timeframe for an energy storage power station to pay back its installation and operational costs can vary significantly due to a range of influencing factors. 1. The average

Get Started

What is energy storage power station project?

Apr 8, 2024 · 1. Energy storage power station projects represent foundational advancements in contemporary energy management, serving several critical

Get Started

How much is the actual profit of energy storage power station?

Feb 12, 2024 · 1. Energy storage power stations generate profits through diverse revenue streams, including ancillary services and capacity payments. 2. Their profitability is also

Get Started

IS ENERGY STORAGE A PROFITABLE BUSINESS MODEL

What does the business model of energy storage power station mean Building upon both strands of work, we propose to characterize business models of energy storage as the combination of

Get Started

Unlocking the Business Profit Model of Energy Storage: Key

Why Energy Storage Is the Swiss Army Knife of Modern Power Systems Imagine electricity grids as highways – sometimes jam-packed (peak hours), sometimes eerily empty (off-peak

Get Started

Business Models and Profitability of Energy

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy

Get Started

1gw energy storage power station feasibility study report

More than 1GW of battery storage will replace coal-fired power generation in the world''''s largest isolated grid. Jun 24, 2022. The Western Australian government is about to embark on an

Get Started

How is the profit of pumped storage power

Jun 23, 2024 · The profit generated from pumped storage power generation hinges on several pivotal factors, which can be articulated as 1. Energy price

Get Started

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Get Started

Energy Storage Power Station Tax Policy: What Investors and

Jul 7, 2025 · Let''s face it – tax policies aren''t exactly the sexiest part of renewable energy discussions. But here''s the kicker: understanding these policies could mean the difference

Get Started

Energy Storage Power Station Capital: The Backbone of

May 5, 2021 · Why Energy Storage Projects Are Eating Wall Street''s Lunch Let''s face it: the energy storage power station capital game has become the new Wild West of infrastructure

Get Started

The Largest Shared Energy Storage Power Station: Revolutionizing Energy

Dec 12, 2019 · Case Study: When Texas Froze, Shared Storage Didn''t During the 2021 Texas power crisis, a 100 MW shared storage project in Austin kept hospitals running while the grid

Get Started

How about investing in a new energy storage power station?

Apr 17, 2024 · Investing in a new energy storage power station offers numerous advantages and significant considerations for stakeholders involved. 1. Energy storage systems facilitate the

Get Started

Luneng national energy storage power station

6 days ago · CATL contributes to protecting natural environment at the Sanjiangyuan areaAt 11:16 a.m. on December 25, 2018, the 50 MW/100 MWh

Get Started

Battery storage power station – a comprehensive

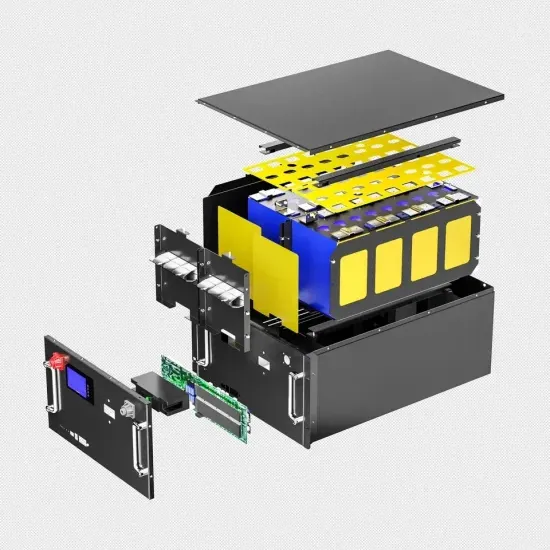

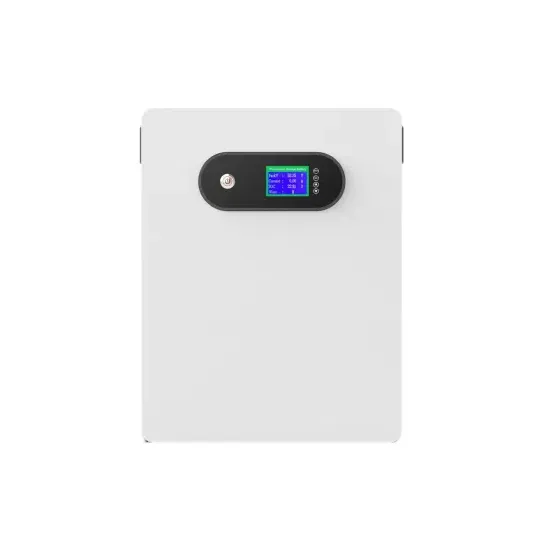

2 days ago · Battery storage power stations store electrical energy in various types of batteries such as lithium-ion, lead-acid, and flow cell batteries. These

Get Started

How much is the profit of energy storage power station

Jan 17, 2024 · The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Get Started

6 FAQs about [Is the energy storage power station project profitable ]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Related Articles

-

Mozambique Energy Storage Power Station Investment Project

Mozambique Energy Storage Power Station Investment Project

-

West Africa Power Station Energy Storage Signed Project

West Africa Power Station Energy Storage Signed Project

-

Energy storage power station manufacturing project scale

Energy storage power station manufacturing project scale

-

Austria Energy Storage Power Station Procurement Project

Austria Energy Storage Power Station Procurement Project

-

Djibouti Energy Storage Power Station Project

Djibouti Energy Storage Power Station Project

-

Price of photovoltaic power station energy storage project

Price of photovoltaic power station energy storage project

-

German photovoltaic power station energy storage project

German photovoltaic power station energy storage project

-

Energy storage power station merger and acquisition project

Energy storage power station merger and acquisition project

-

German power plant energy storage power station project

German power plant energy storage power station project

-

Sucre Group Energy Storage Power Station Project

Sucre Group Energy Storage Power Station Project

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.