Economic benefit evaluation model of distributed energy storage

Jan 5, 2023 · Participation in reactive power compensation, renewable energy consumption and peak-valley arbitrage can bring great economic benefits to the energy storage project, which

Get Started

Optimization analysis of energy storage application based on

Nov 15, 2022 · When the wind-PV-BESS is connected to the grid, the BESS stores the energy of wind-PV farms at low/valley electricity price, releases the stored energy to the grid at

Get Started

Industrial and commercial energy storage profit

Let''s first understand what is the grid peak and valley spread arbitrage. Grid peak-valley spread arbitrage refers to the commercial behavior of purchasing

Get Started

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get Started

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the

Get Started

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · • Optimising the initial state of charge factor improves arbitrage profitability by 16 %. • The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. •

Get Started

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · Highlights • Exploring the retrofitting of coal-fired power plants as grid-side energy storage systems • Proposing a size configuration and scheduling co-optimisation framework of

Get Started

Introduction of industrial and commercial

May 15, 2023 · The profit model of industrial and commercial energy storage is peak-valley arbitrage, that is, a low electricity price is used to charge in the

Get Started

Energy Storage Systems for Commercial and Industrial

Nov 26, 2024 · The Role of Energy Storage in Commercial and Industrial Applications Energy storage plays a crucial role in enhancing the resilience and efficiency of commercial and

Get Started

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · On the other hand, references [35,36] do not consider the impact of energy storage utilizing peak and off-peak electricity price arbitrage on the peak-shaving cost of the power

Get Started

Optimization analysis of energy storage application based on

Nov 15, 2022 · On the one hand, the battery energy storage system (BESS) is charged at the low electricity price and discharged at the peak electricity price, and the revenue is obtained

Get Started

Energy arbitrage and peak shaving in the

May 17, 2024 · What is the role of energy arbitrage and peak shaving with renewable energy integration? Peak shaving and energy arbitrage strategies

Get Started

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

Get Started

Peak and Valley Arbitrage_One Profit For C & I Energy Storage

The following introduce one of profit channels analysis for the industrial and commercial energy storage system. The most

Get Started

Three Investment Models for Industrial and

Sep 30, 2023 · 1. Owner Self-Investment Model The energy storage owner''s self-investment model refers to a model in which enterprises or individuals

Get Started

Combined Source-Storage-Transmission

Jun 20, 2022 · In this study, a source-storage-transmission joint planning method is proposed considering the comprehensive incomes of energy storage. The

Get Started

Peak and Valley Arbitrage_One Profit For C & I Energy Storage

As an emerging business model, energy storage grid peak-valley spread arbitrage has injected vitality into the electricity market. In this paper, we will discuss what grid peak-valley spread

Get Started

Industrial and commercial energy storage profit

Jul 24, 2023 · Arbitrage behavior encourages the investment and construction of energy storage equipment and promotes the application and development of

Get Started

Incorporate robust optimization and demand defense for

Aug 15, 2024 · To tackle these issues, this paper develops a novel business mode to enable rental energy storage sharing among multiple users within an industrial park, and propose a

Get Started

Evaluation and optimization for integrated photo-voltaic and

Oct 20, 2024 · Evaluation and optimization for integrated photo-voltaic and battery energy storage systems under time-of-use pricing in the industrial park

Get Started

Energy Storage Arbitrage Under Price Uncertainty: Market

Jan 15, 2025 · We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization

Get Started

Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time,

Get Started

Arbitrage analysis for different energy storage technologies

Nov 1, 2021 · Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods. The

Get Started

The user-side energy storage investment under subsidy

May 15, 2025 · We develop a real options model for firms'' investments in the user-side energy storage. After the investment, the firms obtain profits through the peak-valley electricity price

Get Started

Optimized Economic Operation Strategy for Distributed

Aug 11, 2023 · Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

Get Started

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · 1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods

Get Started

Economic benefit evaluation model of distributed energy storage

Jan 5, 2023 · Firstly, based on the four-quadrant operation characteristics of the energy storage converter, the control methods and revenue models of distributed energy storage system to

Get Started

Profitability of energy arbitrage net profit for grid-scale

Aug 1, 2024 · Profitability of energy arbitrage net profit for grid-scale battery energy storage considering dynamic efficiency and degradation using a linear, mixed-integer linear, and mixed

Get Started

A Beginner''s Guide to Energy Storage Arbitrage

Nov 16, 2023 · Energy storage arbitrage, like a financial wizardry trick with batteries, involves storing electricity when it''s abundant and cheap to release it

Get Started

Optimized Economic Operation Strategy for

Dec 24, 2020 · Simulation results of distributed energy storage for typical industrial large users show that the proposed strategy can effectively improve

Get Started

Peak-valley arbitrage energy storage costs

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

Get Started

Optimized Economic Operation Strategy for Distributed Energy Storage

TL;DR: Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

Get Started

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · Distributed energy storage (DES) on the user side has two commercial modes including peak load shaving and demand management as main profit modes to gain profits,

Get Started

6 FAQs about [Is the peak-to-valley arbitrage profit from Juba s industrial energy storage substantial ]

What is Peak-Valley price arbitrage?

1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and discharging during peak hours (high rates), businesses achieve direct cost savings. Key Considerations:

How energy storage systems can be used to generate arbitrage?

Due to the increased daily electricity price variations caused by the peak and off-peak demands, energy storage systems can be utilized to generate arbitrage by charging the plants during low price periods and discharging them during high price periods.

What is the maximum daily revenue through arbitrage?

Maximum daily revenue through arbitrage varies with roundtrip efficiency. Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods. The time-varying mismatch between electricity supply and demand is a growing challenge for the electricity market.

How do price differences influence arbitrage by energy storage?

Price differences due to demand variations enable arbitrage by energy storage. Maximum daily revenue through arbitrage varies with roundtrip efficiency. Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods.

Can arbitrage characteristics and breakeven costs guide energy storage system development?

The results indicate that the arbitrage characteristics and breakeven costs can be used to guide the choice of energy storage system development (capacity, effectiveness, and cost) and to determine the constraints and potential economic benefits for stakeholders who are considering investing in energy storage systems.

What is the arbitrage strategy?

The present arbitrage strategy is designed for the given technology attributes (including round-trip efficiency) to store the off-peak energy when the electricity price is low and releases the energy when the price is high (during the peak demand period).

Related Articles

-

Juba Industrial Energy Storage Cabinet Customization Company

Juba Industrial Energy Storage Cabinet Customization Company

-

Energy Storage Industrial Park Project

Energy Storage Industrial Park Project

-

How to sell industrial and commercial energy storage cabinets in Stockholm

How to sell industrial and commercial energy storage cabinets in Stockholm

-

Moldova Industrial Energy Storage Cabinet Customized Manufacturer

Moldova Industrial Energy Storage Cabinet Customized Manufacturer

-

Industrial and commercial energy storage cabinet charging and discharging test equipment

Industrial and commercial energy storage cabinet charging and discharging test equipment

-

Paraguay Industrial and Commercial Energy Storage Cabinets

Paraguay Industrial and Commercial Energy Storage Cabinets

-

Ukrainian industrial energy storage service provider

Ukrainian industrial energy storage service provider

-

Vietnam Ho Chi Minh Industrial and Commercial Energy Storage Cabinet Supplier

Vietnam Ho Chi Minh Industrial and Commercial Energy Storage Cabinet Supplier

-

Brunei Industrial Energy Storage Cabinet Quote

Brunei Industrial Energy Storage Cabinet Quote

-

Serbia EK Industrial and Commercial Energy Storage Cabinet

Serbia EK Industrial and Commercial Energy Storage Cabinet

Commercial & Industrial Solar Storage Market Growth

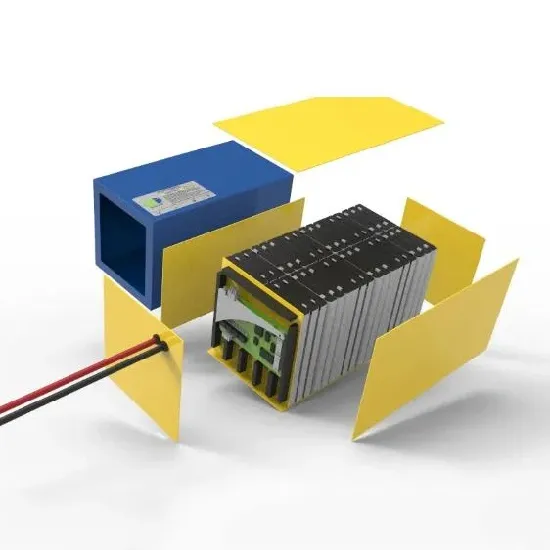

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.