Deploying Battery Energy Storage Solutions in Tunisia

Nov 21, 2023 · solar PV and wind together accounting for nearly 70%. The integration of these variable energy sources into national energy grids will largely depend on storage technologies,

Get Started

is there a future for peak-to-valley arbitrage in energy storage

The expansion of peak-to-valley electricity price difference results in a new business model (1): peak-to-valley energy storage arbitrage Using peak-to-valley spread arbitrage is currently the

Get Started

Stochastic optimal allocation of grid-side

Oct 23, 2024 · Therefore, a two-stage stochastic optimal allocation model for grid-side independent ES (IES) considering ES participating in the operation of

Get Started

Peak-valley arbitrage energy storage costs

By installing a centralised energy storage, the peak-valley arbitrage of transformer stations to the utility power grid is realised, which reduces the total investment of 103.924 million yuan in

Get Started

Peak-valley arbitrage energy storage | Solar Power Solutions

Optimal robust sizing of distributed energy storage considering Additionally, the DESS sells purchased electricity to the upper power grid during peak electricity periods (i.e. 9:00–11:00

Get Started

Operation steps for peak valley arbitrage of user side energy

Nov 10, 2023 · During peak hours, that is, during peak electricity demand, the energy stored in energy storage devices is released. This can be achieved by supplying electricity to one''s own

Get Started

2MW/4MWh Energy Storage Project(New Materials

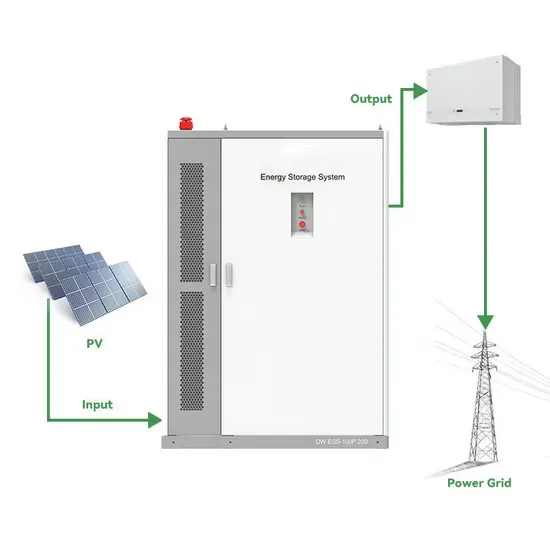

A smart energy storage power station system is constructed. This project builds an industrial and commercial energy storage power station on the user side with Sav''s integrated AC/DC

Get Started

Operation steps for peak valley arbitrage of user side energy

Nov 10, 2023 · 2、Analyze peak and valley periods and plan formulation: Based on the collected electricity price data, analyze the differences in electricity prices during different periods.

Get Started

Energy storage peak-valley arbitrage case

Through case simulations, it is demonstrated that the point-to-point commercial model is beneficial for both shared energy storage and users. providing more opportunities for energy

Get Started

peak-valley arbitrage energy storage manufacturer ranking

Energy Storage on The Power Generation Side Market Share 2024-Global Trends, Top Our in-depth Report [108 Pages] on the Energy Storage on The Power Generation Side Market

Get Started

Peak-Valley Arbitrage

By strategically charging batteries during low-cost valley periods and discharging them during high-cost peak periods, factories can significantly reduce their

Get Started

Peak-valley arbitrage energy storage costs

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

Get Started

energy storage achieves peak-valley arbitrage

Energy storage on the grid-side, relying on the "mandatory storage" policy, has a low utilization rate; industrial and commercial energy storage has a single profit model, overly dependent on

Get Started

Peak-Valley Arbitrage

Mar 3, 2025 · In today''s dynamic energy market, managing costs is more critical than ever for factories and industrial facilities. One of the most effective strategies for reducing energy

Get Started

Energy storage peak and valley solution

Feb 20, 2025 · Abstract: In order to make the energy storage system achieve the expected peak-shaving and valley-filling effect, an energy-storage peak-shaving scheduling strategy

Get Started

User-side Solution PV Power Station Energy Storage

Jun 17, 2022 · C&I ESS solutions Industrial and commercial energy storage systems can not only realize peak-valley arbitrage, but also reduce transformer capacity costs. Megarevo MEGA

Get Started

Peak-Valley Arbitrage

In today''s dynamic energy market, managing costs is more critical than ever for factories and industrial facilities. One of the most effective strategies for reducing energy expenses is

Get Started

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · The peak-valley difference on the grid side can be adjusted by energy storage to achieve peak-shaving of renewable energy power systems, which was discussed in [ [5], [6], [7]].

Get Started

INDUSTRY ENERGY ARBITRAGE

Industry Energy Arbitrage unlocks the value hidden in energy price fluctuations by intelligently shifting consumption and storage. Unlike traditional energy-saving approaches that focus

Get Started

Exploring Peak Valley Arbitrage in the Electricity

Apr 28, 2024 · Peak valley arbitrage presents a compelling opportunity within the electricity market, leveraging price differentials between peak and off-peak

Get Started

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · The CFPP-retrofitted grid-side ESS is profitable via energy arbitrage at the considered realistic electricity tariff profile (annual peak-valley tariff gap of 132 USD/MWh and

Get Started

Capacity tariff mechanism design for grid-side energy storage

Aug 1, 2025 · However, the deployment of grid-side energy storage has primarily depended on government subsidies. This paper proposes a capacity tariff mechanism for grid-side energy

Get Started

Industry Peak-Valley Arbitrage

Peak-Valley Arbitrage For Industry Electricity Saving Maximize Factory Savings with Peak and Valley Energy Arbitrage In today''s dynamic energy market, managing costs is more critical

Get Started

BESS Arbitrage – Li-ion battery design and manufacture

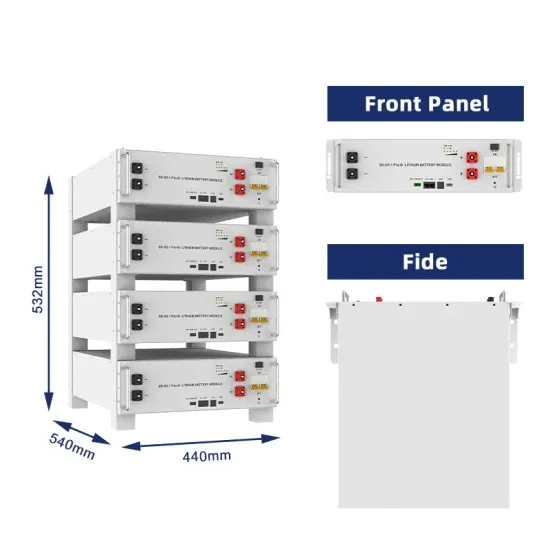

This scalable solution, extending from 3.42 MWh to 102.6 MWh, is perfect for medium to large-scale industrial users and grid operators implementing peak-valley arbitrage. The batteries are

Get Started

Peak and Valley Arbitrage_One Profit For C & I Energy Storage

As an emerging business model, energy storage grid peak-valley spread arbitrage has injected vitality into the electricity market. In this paper, we will discuss what grid peak-valley spread

Get Started

Peak-valley arbitrage scheme for grid-side energy storage in

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

Get Started

获取多场景收益的电网侧储能容量优化配置

Apr 20, 2021 · In view of the current grid energy storage system, application scena-rio is relatively single, we propose a grid side energy storage capacity allocation method that takes into

Get Started

Peak-valley arbitrage of energy storage power stations in

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

Get Started

Energy Storage Arbitrage Under Price Uncertainty:

Jan 16, 2025 · Energy storage participants in electricity markets leverage price volatility to arbitrage price differences based on forecasts of future prices, making a profit while aiding grid

Get Started

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get Started

6 FAQs about [Tunisia grid-side energy storage peak-valley arbitrage solution]

What is energy arbitrage?

Energy arbitrage means that ESSs charge electricity during valley hours and discharge it during peak hours, thus making profits via the peak-valley electricity tariff gap [ 14 ]. Zafirakis et al. [ 15] explored the arbitrage value of long-term ESSs in various electricity markets.

Is a retrofitted energy storage system profitable for Energy Arbitrage?

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage.

Is energy arbitrage profitability a sizing and scheduling Co-Optimisation model?

It proposes a sizing and scheduling co-optimisation model to investigate the energy arbitrage profitability of such systems. The model is solved by an efficient heuristic algorithm coupled with mathematical programming.

Are energy storage systems more cost-effective than batteries for Energy Arbitrage?

The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage. In the context of global decarbonisation, retrofitting existing coal-fired power plants (CFPPs) is an essential pathway to achieving sustainable transition of power systems.

What is the optimal SoC factor for Energy Arbitrage?

With the optimal value of 24 %, the remaining capacity and operational flexibility of the ESS can be properly balanced, so as to achieve the full operational cycle of energy arbitrage and the highest profit. Compared to the default value as in previous work (50 %), the optimal initial SOC factor increases the annual arbitrage profit by 16 %.

What is arbitrage profit?

The arbitrage profit refers to the electricity sales revenue during peak periods minus the electricity purchase cost during valley periods, which is optimised in the lower-level scheduling model. It is assumed that the salvage value of the boiler offsets its destruction cost to reasonably simplify the economic model.

Related Articles

-

Price of 150 kWh energy storage solution

Price of 150 kWh energy storage solution

-

Japan Osaka Factory Energy Storage Solution

Japan Osaka Factory Energy Storage Solution

-

Energy storage peak shaving and valley filling solution

Energy storage peak shaving and valley filling solution

-

Lobamba Energy Storage BMS Solution

Lobamba Energy Storage BMS Solution

-

Basseterre 30kw energy storage solution

Basseterre 30kw energy storage solution

-

Lome Energy Storage Power Station Solution

Lome Energy Storage Power Station Solution

-

Naypyidaw Smart Energy Storage Cabinet Solution

Naypyidaw Smart Energy Storage Cabinet Solution

-

Italian electromagnetic energy storage solution

Italian electromagnetic energy storage solution

-

Design of outdoor energy storage solution in Zimbabwe

Design of outdoor energy storage solution in Zimbabwe

-

Is the peak-to-valley arbitrage profit from Juba s industrial energy storage substantial

Is the peak-to-valley arbitrage profit from Juba s industrial energy storage substantial

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.