Container energy storage profit model

Analysis and Comparison for The Profit Model of Energy Storage Power Station The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of

Get Started

Profit model of energy storage battery project

Profitability of commercial and industrial photovoltaics and battery projects To address this gap, we develop a novel techno-economic optimization model for C&I PV and battery projects,

Get Started

Battery Energy Storage System Production Cost

Case Study on Battery Energy Storage System Production: A comprehensive financial model for the plant''s setup, manufacturing, machinery and operations.

Get Started

Analysis of the profit model of energy storage projects

What are business models for energy storage? Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model

Get Started

Modeling and analysis of liquid-cooling thermal

Sep 1, 2023 · Modeling and analysis of liquid-cooling thermal management of an in-house developed 100 kW/500 kWh energy storage container consisting of lithium-ion batteries retired

Get Started

浙江新型储能收益模式及经济性实证分析

Feb 27, 2025 · 为此,本文以浙江省内某50 MW/100 MWh电化学储能站示范项目作为典型案例,首先分析了其技术条件和投资情况,进一步计算了其在电力市场、中长期合约和容量租赁服务等方

Get Started

Simulation analysis and optimization of containerized energy storage

Sep 10, 2024 · In recent years, in order to promote the green and low-carbon transformation of transportation, the pilot of all-electric inland container ships has been widely promoted [1].

Get Started

The energy storage mathematical models for simulation and

Jul 8, 2023 · Energy storage systems are increasingly used as part of electric power systems to solve various problems of power supply reliability. With increasing power of the energy storage

Get Started

Business Models and Profitability of Energy Storage

Oct 23, 2020 · We then use the framework to examine which storage technologies can perform the identified business models and review the recent literature regarding the profitability of

Get Started

Energy Storage Valuation: A Review of Use Cases and

Jun 24, 2022 · Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any

Get Started

Energy Storage Power Station Profit Analysis: Where

Oct 28, 2020 · Let''s face it – when most people hear "energy storage," they picture clunky car batteries or that forgotten power bank in their junk drawer. But energy storage power station

Get Started

Containerized Energy Storage: A Revolution in

Jan 19, 2024 · 2. Flexibility in Moving Energy Storage One of the standout advantages of containerization is the flexibility it provides in moving energy

Get Started

Energy storage project profitability analysis

Business Models. We propose to characterize a "business model" for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the

Get Started

how much profit can be made from processing energy storage containers

Analysis and Comparison for The Profit Model of Energy Storage Therefore, this article analyzes three common profit models that are identified when EES participates in peak-valley arbitrage,

Get Started

Characteristics analysis of energy storage containers

What should be included in a technoeconomic analysis of energy storage systems? For a comprehensive technoeconomic analysis,should include system capital investment,operational

Get Started

Profits from processing energy storage containers

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Get Started

Energy Storage Feasibility and Lifecycle Cost Assessment

To evaluate the technical, economic, and operational feasibility of implementing energy storage systems while assessing their lifecycle costs. This analysis identifies optimal storage

Get Started

Integrated cooling system with multiple operating modes for

Apr 15, 2025 · Integrated cooling system with multiple operating modes for temperature control of energy storage containers: Experimental insights into energy saving potential

Get Started

Energy Storage Containers Growth Forecast and Consumer

Apr 26, 2025 · The rising adoption of renewable energy sources, such as solar and wind power, necessitates effective energy storage solutions to address intermittency issues. Data centers,

Get Started

Economic Analysis of Customer-side Energy Storage

Sep 9, 2019 · There are many scenarios and profit models for the application of energy storage on the customer side. With the maturity of energy storage technology and the de

Get Started

How to calculate the profit margin of energy storage

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Get Started

Business Models for Utility-Scale Energy Storage in India

Dec 4, 2019 · Business Model and Contract Analysis of US Projects Initially a lot of generation-coupled storage, to benefit from solar-ITC incentives which are being phased-out Increasing

Get Started

The latest profit analysis of the energy storage industry

The energy storage industry was one of the major beneficiaries of the IRA''''s new rules on both the deployment and manufacturing sides. The IRA enacted the long-sought investment tax credit

Get Started

Evaluating energy storage tech revenue

Feb 11, 2025 · The revenue potential of energy storage technologies is often undervalued. Investors could adjust their evaluation approach to get a true

Get Started

Financial Analysis Of Energy Storage

6 days ago · Learn about the powerful financial analysis of energy storage using net present value (NPV). Discover how NPV affects inflation & degradation.

Get Started

Profit analysis of energy storage potential

1The welfare analysis in this paper can be adjusted to include the costs associated with emissions. However, in yield a socially better outcome than load-owned storage. In this

Get Started

Profit analysis of energy storage giants

economic bene?ts of the distributed energy storage. (3) This paper proves that distributed energy storage can obtain economic bene?ts in multi-pro?t mode, and the pro-posed strategy can be

Get Started

Profit analysis of energy storage applications

The cost of an energy storage system is often application-dependent. Carnegie et al. [94] identify applications that energy storage devices serve and compare costs of storage devices for the

Get Started

Which profit analysis should be selected for energy

Battery Energy Storage Systems, such as the one in Mongolia, are modular and conveniently housed in standard shipping containers, enabling versatile deployment. When planning the

Get Started

6 FAQs about [Analysis of the profit model of energy storage containers]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

Is energy storage a tipping point for profitability?

We also find that certain combinations appear to have approached a tipping point towards profitability. Yet, this conclusion only holds for combinations examined most recently or stacking several business models. Many technologically feasible combinations have been neglected, profitability of energy storage.

How does stacking affect profitability?

Stacking describes the simultaneous serving of two or more business models with the same storage unit. This can allow a storage facility business model with operation in anothe r. To assess the effect of stacking on profitability, we business models. Figure 3 shows that the stacking of two business models can already improve

Related Articles

-

Lobamba energy storage system peak shaving and valley filling profit model

Lobamba energy storage system peak shaving and valley filling profit model

-

Profit analysis of telecom energy storage cabinets

Profit analysis of telecom energy storage cabinets

-

Managua Energy Storage Power Station Profit Model

Managua Energy Storage Power Station Profit Model

-

Energy Storage Power Station EPC Profit Model

Energy Storage Power Station EPC Profit Model

-

Kenya Mombasa Energy Storage Power Station Profit Model

Kenya Mombasa Energy Storage Power Station Profit Model

-

Polish energy storage containers for sale

Polish energy storage containers for sale

-

Small Energy Storage System Financing Model

Small Energy Storage System Financing Model

-

What is the model of Iceland s heavy industry energy storage cabinet

What is the model of Iceland s heavy industry energy storage cabinet

-

Maintenance and maintenance requirements for energy storage containers

Maintenance and maintenance requirements for energy storage containers

-

Photovoltaic energy storage cabinet model

Photovoltaic energy storage cabinet model

Commercial & Industrial Solar Storage Market Growth

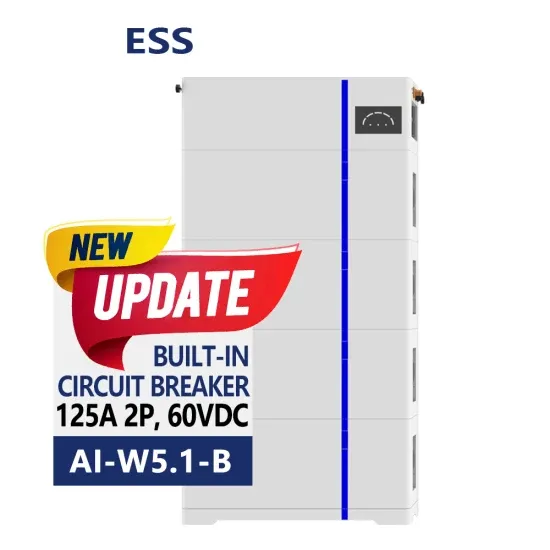

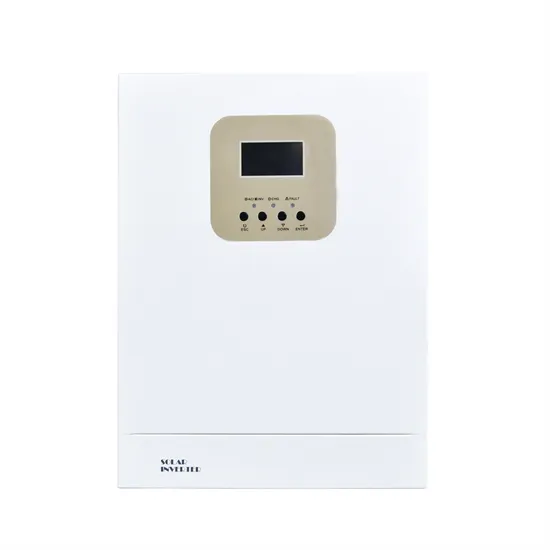

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

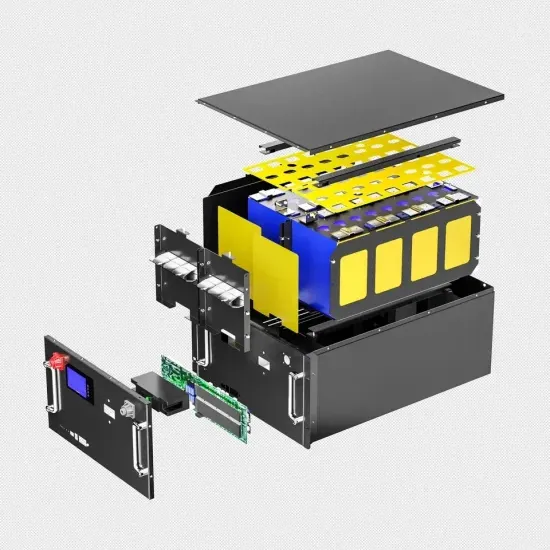

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.